Some stuff I am reading today morning:

Effect of BJP’s win on the markets (BL)

UTI AMC close to IPO (Mint)

Stay away from CL Educate IPO (MyInvestmentIdeas)

Lessons from Raymond Vs Bharat Patel fracas (MoneyLife)

How the Bangurs of Shree Cement salvaged a legacy (Forbes)

ShopClues’s Agarwal Vs Agarwal (ET)

Trump’s Trade Hammer (Bloomberg)

Markets defy Finance theory on Fed Hikes (Ben Carlson)

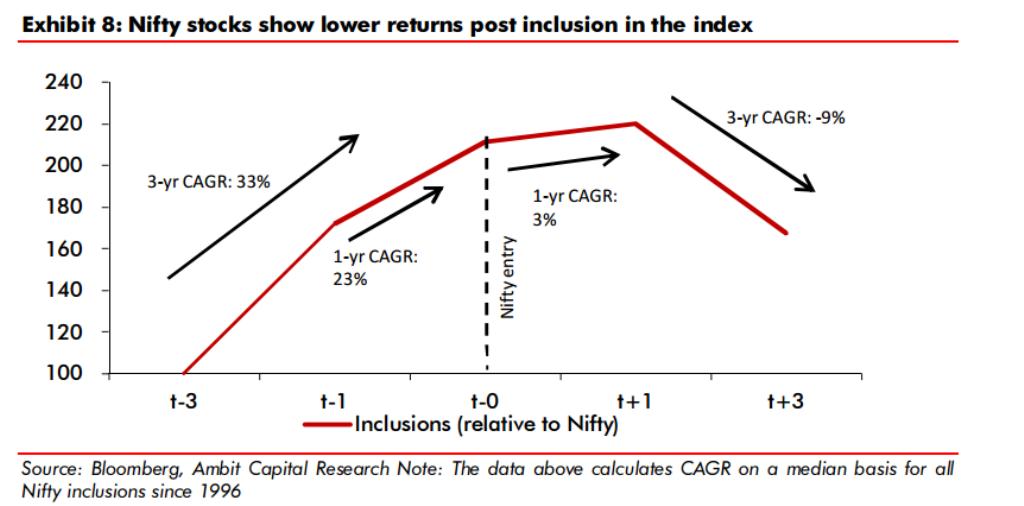

Why Good (Bad) Companies can be Bad (Good) investments (Aswath Damodaran)

Does past success change future returns? (Ivanhoff)