Some stuff I am reading today morning:

Italy polls gets worse as referendum nears (Reuters)

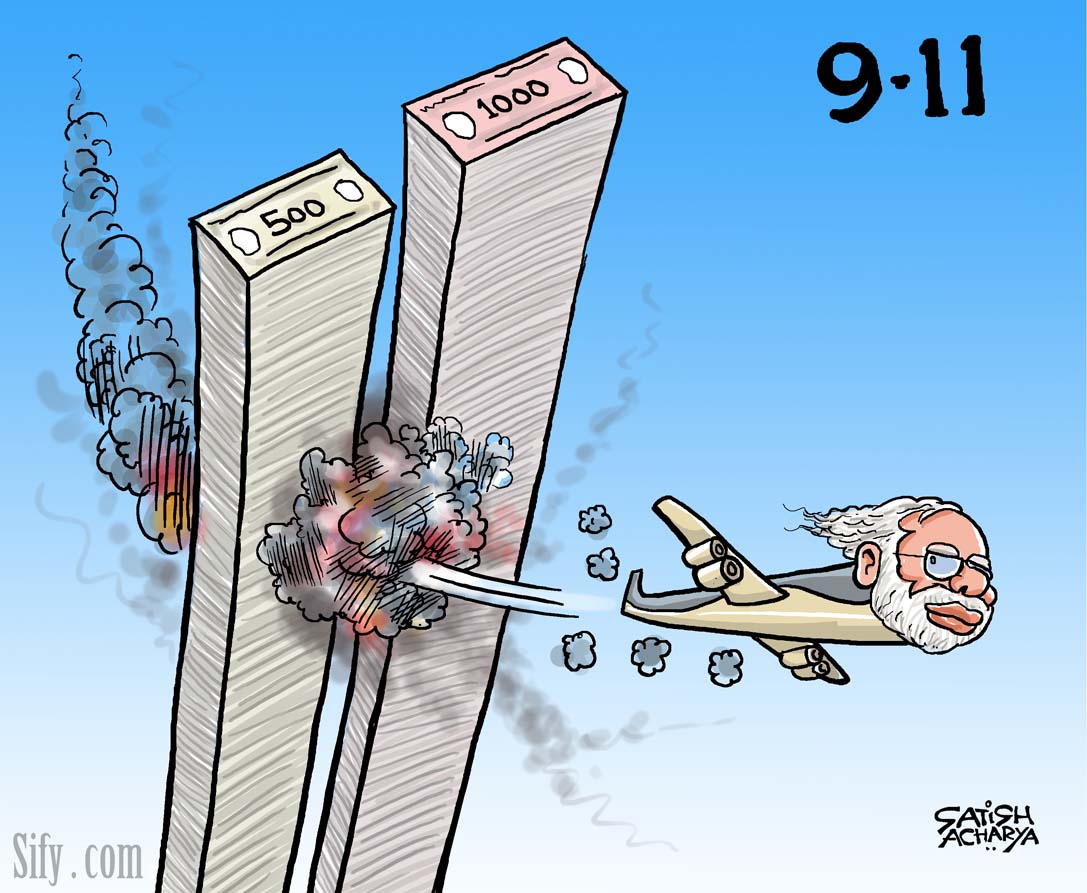

ATM chaos,demonetisation woes (FirstPost)

Drop in Dabba market trades add to liquidity crisis (Money Control)

Cyrus Mistry: Ratan Tata paid Nira Radia 40 Cr/year ! (ET)

Why DVRs have failed in India (BL)

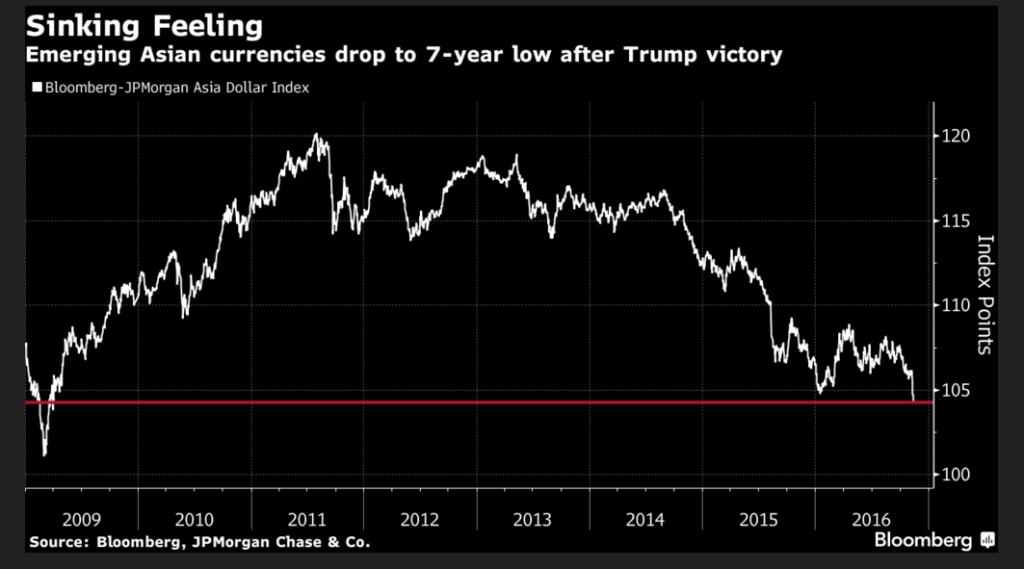

Demonetisation and the Equity Markets (Subramoney)

Tax & Penalty on Cash Deposits (Be Money Aware)

Long-Short investing may shorten your investment life-span (AA)

Warren Buffett is now bullish on airlines (Climateer)

Lawsuits against Welspun,Walmart roil cotton industry (Mint)