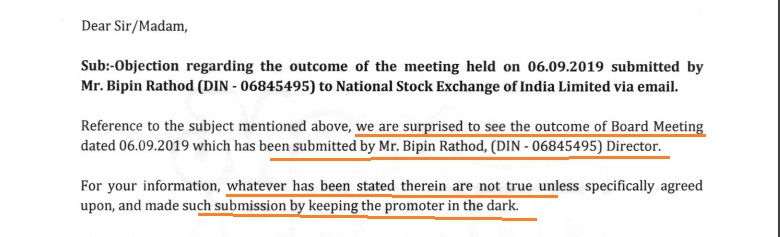

Source: Exchange Filings of Manpasand Beverages Ltd

One of the most remarkable exchange filings ever begins like this:

Source: Exchange Filings of Manpasand Beverages Ltd

One of the most remarkable exchange filings ever begins like this:

Hat Tip: Ivan Maljkovic

Some stuff I am reading today morning:

A fresh Oil crisis (Zero Hedge)

Key takeaways from FM ‘s third press conference (MC)

SEBI mulls whistle-blower mechanism for Auditors (ET)

Stress in the power sector (BS)

Invit or UnFit ? (OB)

Dry spell in IPO (BL)

Profile: Harsh Neotia (Rediff)

Index Fund: The Benchmark (Subramoney)

Letter to a friend who just made a lot of money (Graham Duncan)

Presentation at HT Finance Meet (Manish Bhandari)

Here are the most clicked items on Alpha Ideas this week:

Financial Savings Tsunami ahead (AI)

Lasa Super Generics: Legally Only One (AI)

Suyog Gurbaxani: God save the Investors (AI)

The Robots are coming (AI)

70,000 Cr ticking time bomb (ET)

Misquita Engineering: Superb Client (AI)

Beware of the bear market rally (Prashanth)

Paytm for Dummies (Manoj Nagpal)

Life Lessons from Keshub Mahindra (Wharton)

Boom times for Mutual Funds (BS)