Categories

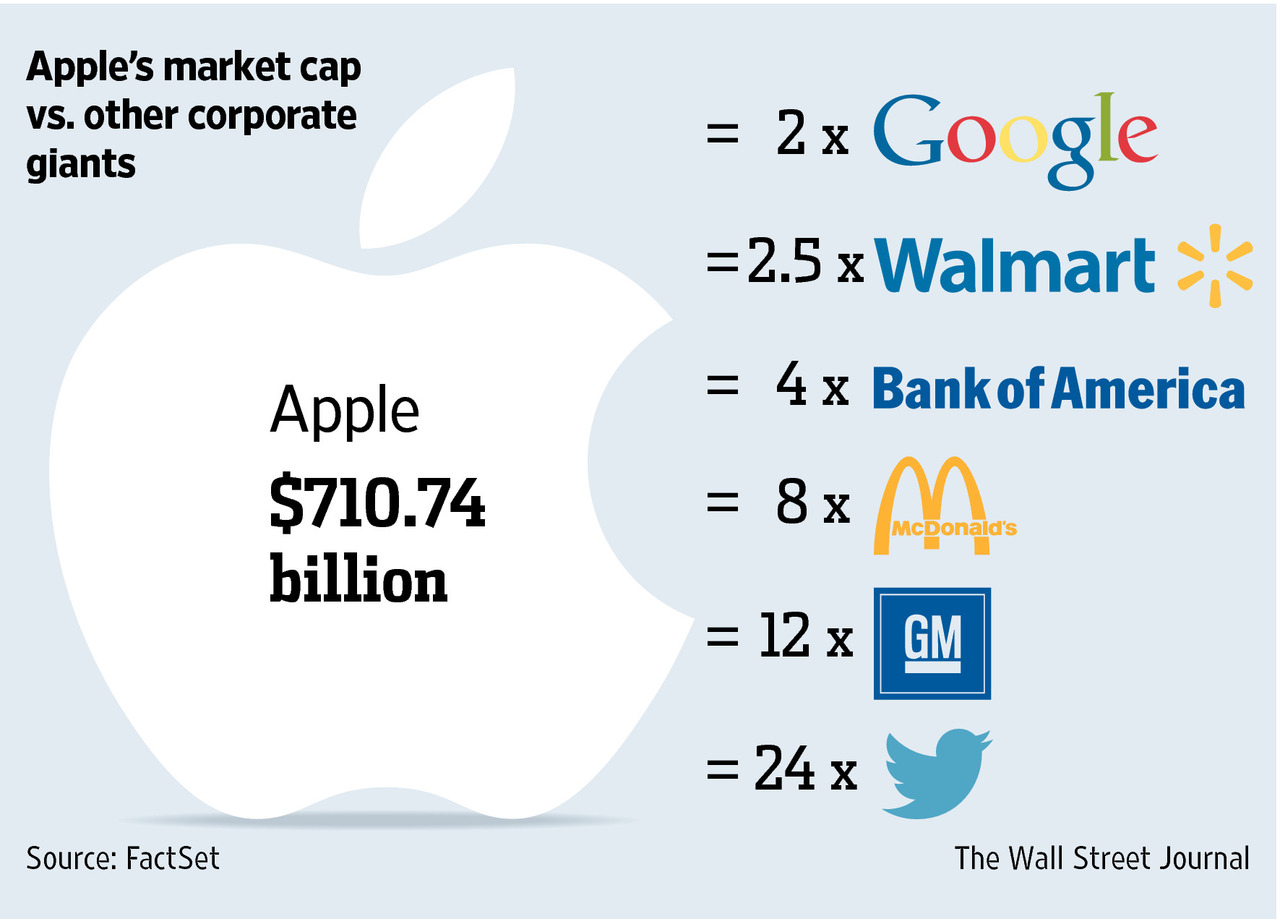

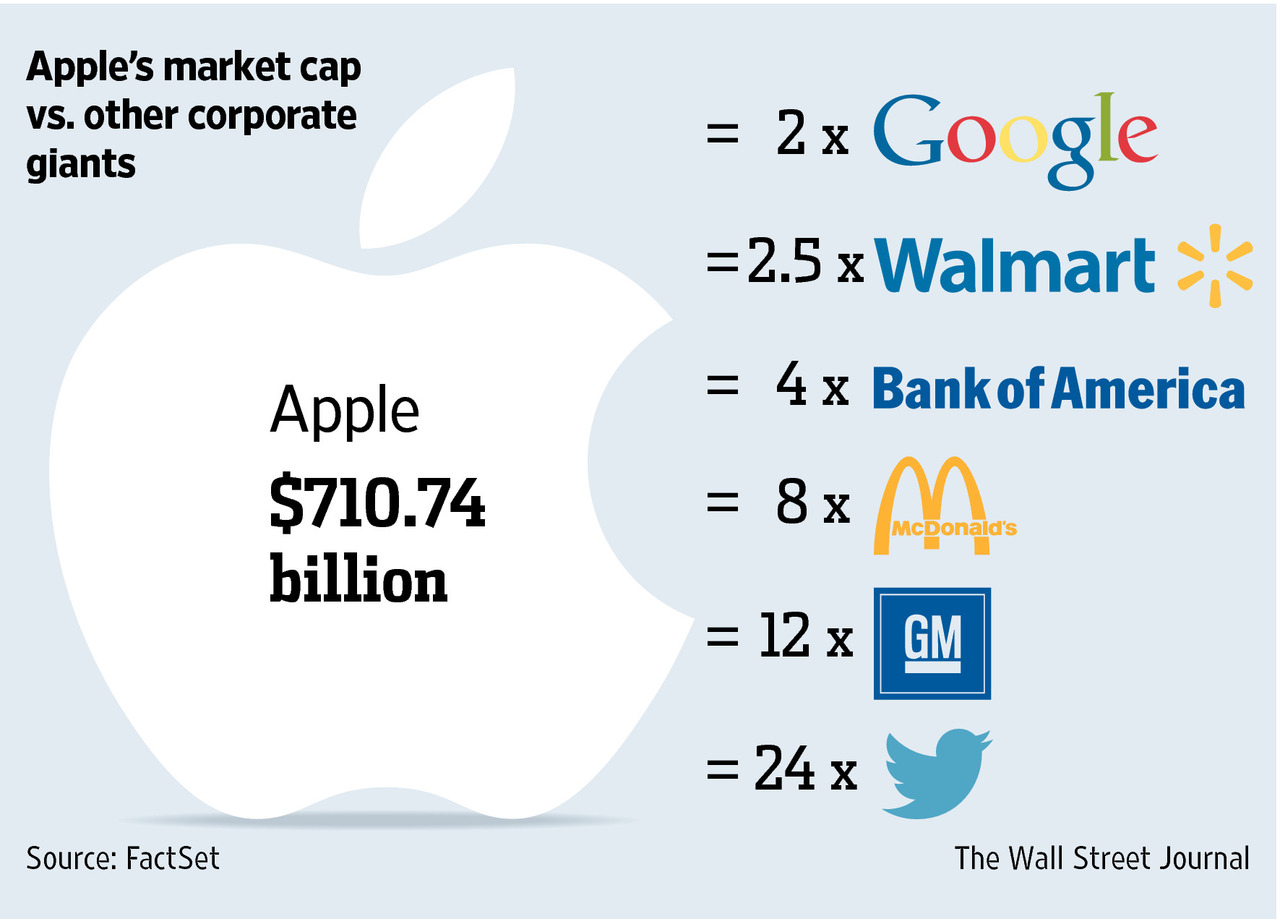

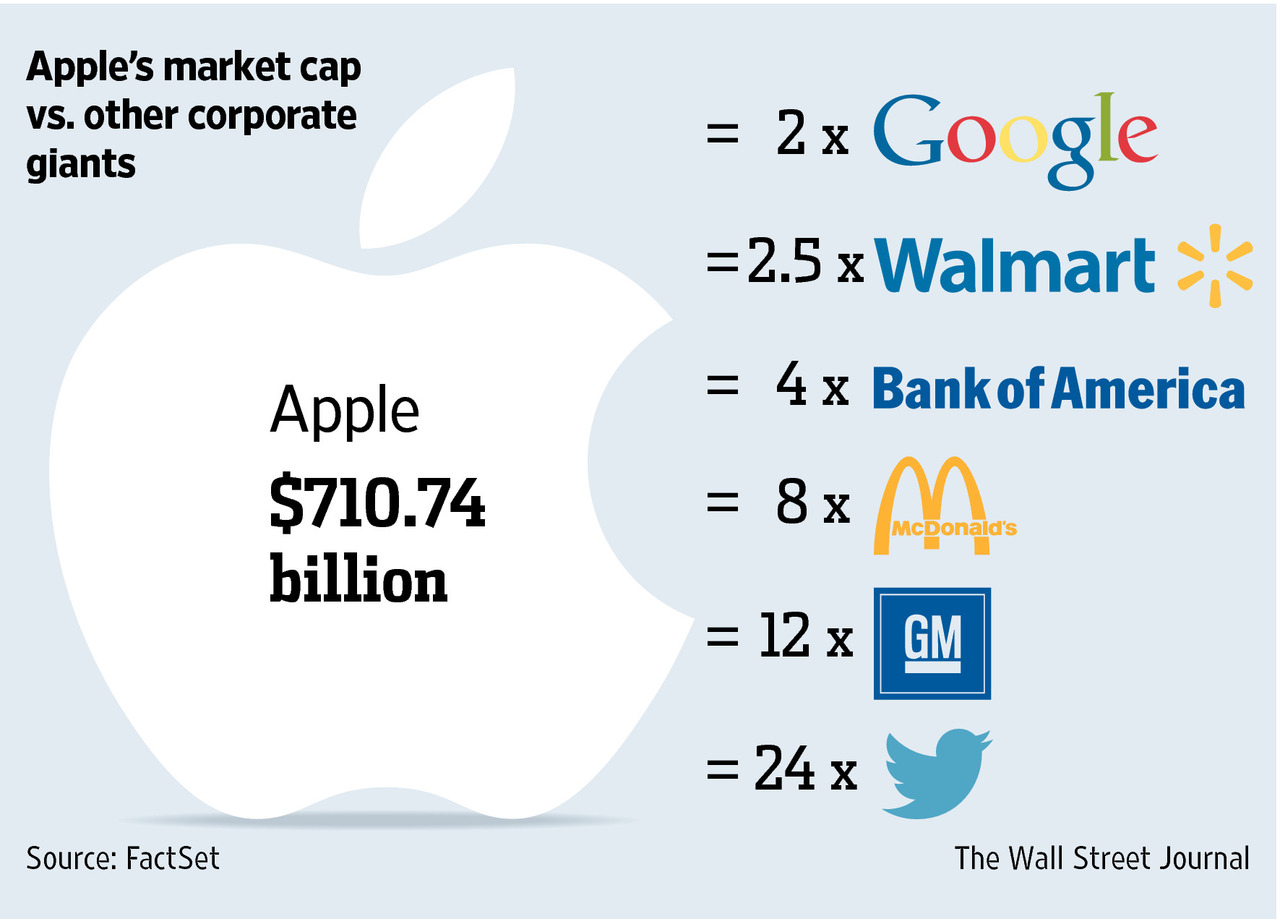

The 700 Billion $ Company

Some stuff I am reading today morning:

The keys to Vijay Mallya’s Goa villa lies in Lisbon (FE)

Not a good idea to ignore Greece (El Erian)

Trading: The one minute challenge (Prashant)

Rakesh Jhunjhunwala’s latest stock pick (RJ)

Investing in mutual funds vis ZipSip (MyInvestmentIdeas)

The 40% rule for startups (A VC)

HSBC are scum (Climateer)

Baltic Dry at lowest level since 1986 (Bloomberg)

Daniel Kahneman’s top advice:Don’t trade too much (InvestmentNews)

A hitch in time (MediaCrooks)

Career advice:

Somewhere between Winning and Surviving is Outlasting – which is way underrated.

Outlast the bastards.

— Downtown Josh Brown (@ReformedBroker) February 11, 2015