Category: Interview

Why FIIs will come to India

Source: The Market

Q: A weaker dollar should be good for emerging markets, shouldn’t it?

Jeffrey Gundlach: Yes, when the dollar tops out, you should own nothing but emerging markets if you’re an extremely aggressive investor. I wouldn’t do it personally because I’m a low-risk personality type, but emerging markets will do very, very well. They’re so cheap compared to developed markets, and their currencies will appreciate, I think, in the next recession. That means you could have a double win when you’re a US dollar-based investor. But I don’t think it’s going to happen this year. That might be a story for 2023

Source: Interview with Jay Powell

Ryssdal: I need you to roll with me on this last one. We’ve got a little game we play on the show. It’s called “What is Jay Powell thinking in five words or less?” And I ask our Friday afternoon panelists when we have a big monetary policy topic come up, I say, “OK, what is Jay Powell thinking in five words or less?” And I would not be able to forgive myself if, sitting across from Jay Powell, I don’t ask Jay Powell what Jay Powell is thinking in five words or less. I should tell you I did this with Obama and he blew it. He went on for like a minute. So, no pressure.

Powell: Five words or less. I’m gonna go with what I really am thinking is, “get inflation back under control.”

Ryssdal: Oh, man. Boom.

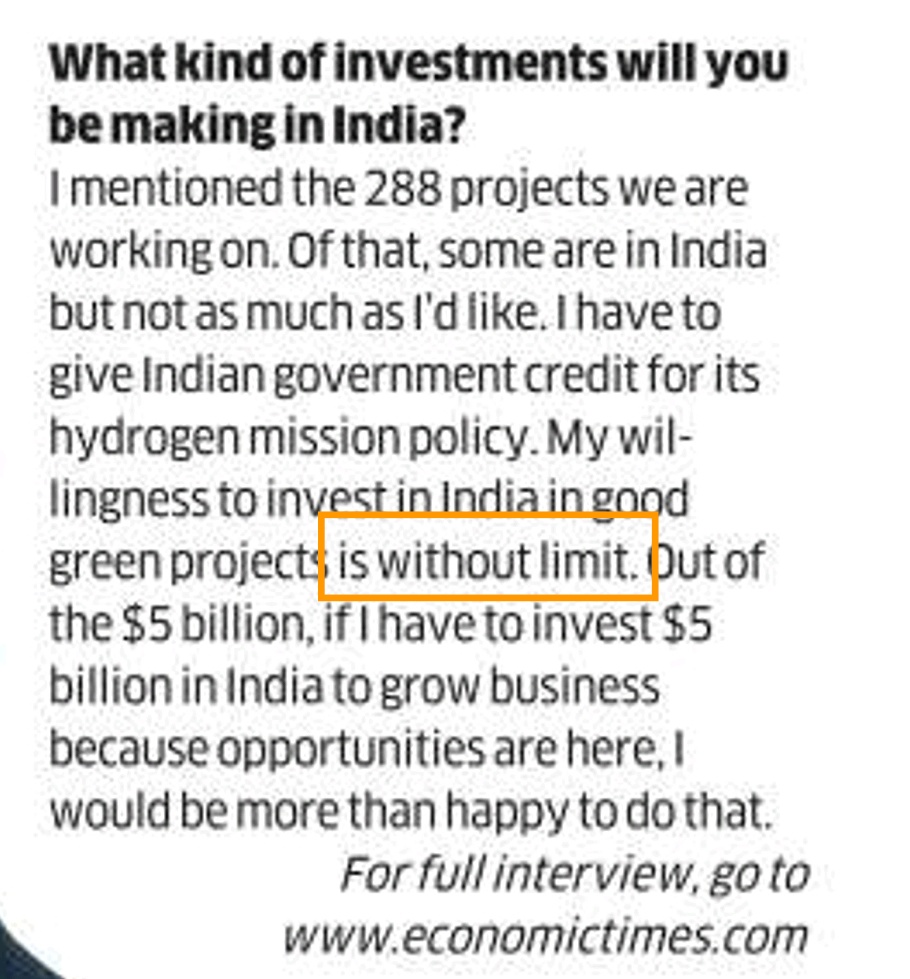

Linde : Without Limit

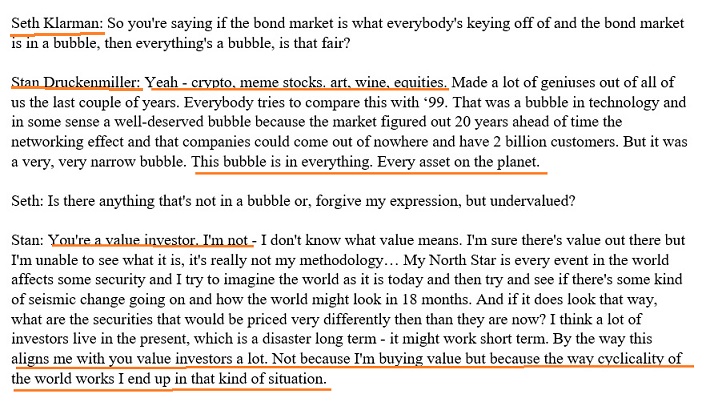

No Geniuses. Only Cycles

Source: Cundill Capital