A great speech by Mohammed Hanif…

Weekend Mega Linkfest:June 22, 2013

Some off beat reads for the weekend:

Prannoy Roy:The last Mogul (Newslaundry)

Goodbye Miami (RollingStone)

Booz Allen, the world’s most profitable organisation (BusinessWeek)

The price of loyalty in Syria (NYTimes)

In Pictures:Marriage and Divorce of Nitish Kumar and Sushil Modi (UnrealTimes)

Walk in Bannerghatta National Park (TeamBHP)

Afghanistan’s unavoidable partition (ProjectSyndicate)

Mumbai’s endangered restaurants (MumbaiBoss)

Inside the world of Black Ops Online Reputation Management (NYMag)

Something fishy happening at Laffans Petrochemicals? (Moneylife)

Hindi cinema still dominates India’s film culture (Caravan)

Manwatching Mr.Modi (OutlookIndia)

Dilli Door Ast (Open)

Photos:Chaos in Brazil (NewYorker)

The coming Arctic boom (ForeignAffairs)

Why the tomato was feared in Europe for more than 200 years (Smithsonian)

Why Swami Vivekananda’s speech was the greatest ever (MarkTully)

Photos:Luxury Tree Houses (VanityFair)

How to address the masturbating child (Atlantic)

Can Iran be stopped? (Economist)

Motilal Oswal had conducted a conclave recently on ETFs.

One of the keynote speakers was Deborah Fuhr from ETFGi who gave a superb presentation on ETFs.

Aashish has graciously agreed to share the same for the readers of Alpha Ideas.

Interesting to know that foreign based ETFs have 5.6 Billion $ of exposure to Indian equities.Thats nearly half the AUM of Indian Mutual Funds !

[gview file=”https://alphaideas.in/wp-content/uploads/2013/06/MOst-ETF-conclave-June-2013.pdf”]

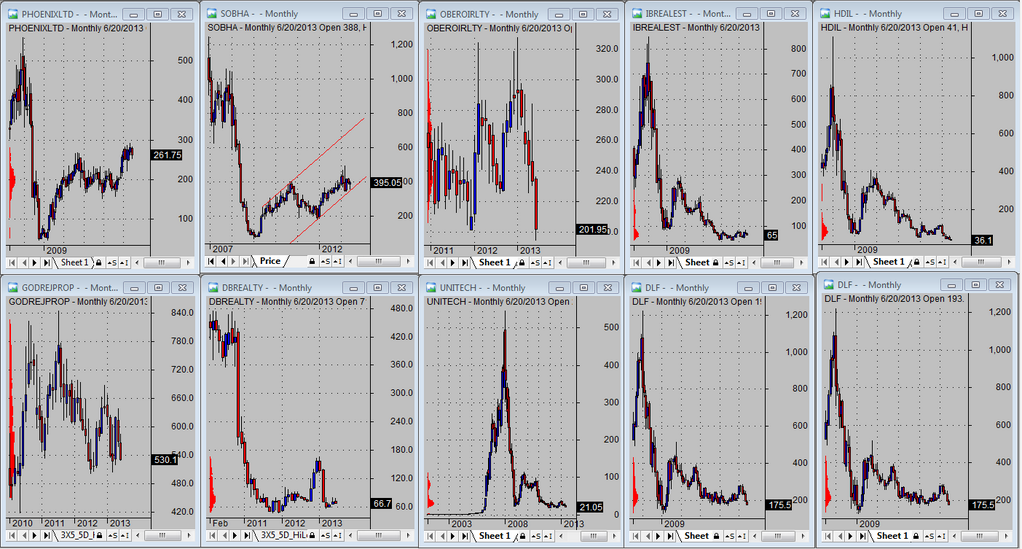

Sorry State of Realty Stocks

(Source Ramgopal25 Via LordLudus)

An peculiar aspect of the Indian equity market is the herd like behavior of its brokerage community.One a meme (idea) takes root it quickly spreads and soon everybody are chasing the same stocks

To illustrate, in 1999-2000 , the IT sector was the meme.All brokerages recommended IT stocks, their clients bought it,so the stocks rose which led to recommendation upgrades and so on till the bubble burst.

The same cycle played out in various sectors over the years…telecom, realty, infra and so on

Recent memes that have done well in the last one year or so are FMCGs, Private banks etc

Now the meme that is fast gaining currency are Export Oriented Companies.

Like all memes, the underlying premise is simple and sound.Our dear Rupee has collapsed from around 45 Rs/$ to around 60 Rs/$. So export oriented companies should be raking in the moolah and laughing all the way to the bank.

Watch out as this idea spreads and becomes popular and brokerages start recommending names for this play.

How to play this game?Soros would have climbed on to the bandwagon, rode the wave up and got out before the collapse.

But then not all of us are destined to be a Soros !