Categories

Algorithmic Trading

Some stuff I am reading today morning:

Yusufalli-The richest Malayalee on the planet (Outlook Business)

5 Trends that define the world economy (Mint)

Power Transmission: The emerging star (BS)

Glaucus Research: Rolta is a fraud (Glaucus)

How to choose a liquid mutual fund (FreeFinCal)

D S Kulkarni has changed its job profile (Ravi)

MEP Infrastucture IPO:Avoid (MyInvestmentIdeas)

FIIs get hit by 40,000 Crs for thinking Capital gains were tax free (CapitalMind)

Pre-IPO trading in the US (WSJ)

The hedge fund business is a “no-excuse” business (Bloomberg)

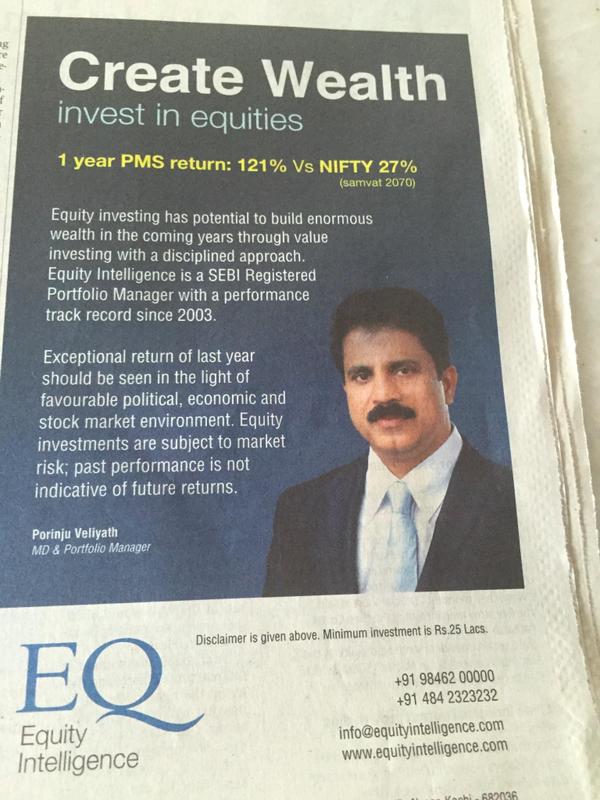

This ad reminds me of this immortal quote

“Bright, energetic people—usually quite young—have promised to perform miracles with “other people’s money” since time immemorial. They have usually been able to do it for a while—or at least to appear to have done it—and they have inevitably brought losses to their public in the end.”- from The Intelligent Investor by Ben Graham

Source:Economist