Linkfest: November 11,2016

Some stuff I am reading today morning:

Modi’s Master Stroke may yield him $45 Billion (Bloomberg)

IT raids on Jewellers,Hawala Operators (TOI)

Full Statement by Tata Sons on why they fired Mistry (Quint)

Tata Chemicals Independent Directors stand by Mistry (Quint)

Research: Demonetisation Impact on Financials (Motilal Oswal)

How to use UPI for digital payments (Vipin)

Living frugally will not make you rich (Subramoney)

Some thoughts on Black Money (Bala)

Household Budgeting:Skip Credit Cards (NYTimes)

John Kapoor-The desi Billionaire nobody knows about (Forbes)

Ratan Tata’s Alternate Universe

In his Alternate Universe, Ratan Tata wants Regulators/Stock Exchanges should question/take clarifications from individuals and not listed companies:

Here, we are only referring to the shocking statement of Cyrus Mistry of five or six major Tata companies having to take ‘potential write-downs of $18 billion’ in future in their assets/investments and the following points/queries need to be raised –

a) Has Mr Mistry, the Chairman, informed the Boards of these companies at any time in the past specifically of the above mentioned potential write-downs? If so, when was this done and why was itnot made public as this is clearly a major item of information – apart from disclosing only the write-offs required to be made to date. Surely he could not have ‘discovered’ such a large potential liability only a day or two after he was replaced as the Chairman of Tata Sons. Therefore, he must have been aware of this potential large provision much earlier but did not disclose it. It presumably relates to possible future provisions to be made (with no firm basis) but only his own expectation, i.e. a forward-looking statement which is normally not permissible due to its uncertainty. It also suggests that he had no intention of or given up any attempt to revive the value of these companies. It is unfortunate that the BSE/NSE have asked the companies to explain this statement and not Mr Mistry as the author of this statement.

b) On the same point, it has been widely reported that this statement of potential write-downs of this magnitude has been largely responsible for the loss in the total market value of these five or six companies of an amount of over Rs 25,000 crore and all the shareholders would naturally be unhappy at this loss in their own value for no fault of theirs but mainly due to this shocking and sudden statement on the part of the Chairman of these companies which may or may not have been shared with the Board and certainly not publicly disclosed earlier. Here again, it is unfortunate that the shareholders and regulatory authorities would put the onus on the companies and not Mr Mistry as the author of the statement for being responsible for this large loss in market value.

Is 2016 like 1978?

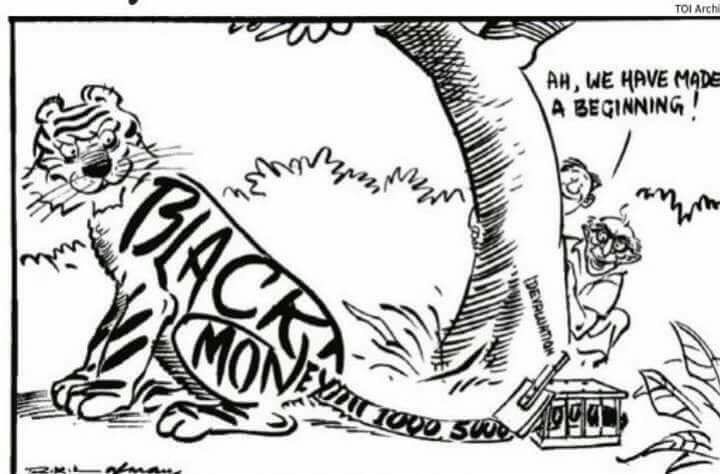

In the year 1978, Janta Party government led by another politician from Gujarat Prime Minister Morarji Desai, had decided to demonitise Rs 1,000, Rs 5,000 and Rs 10,000 notes in a bid to combat corruption and black money.

During that time too, people were as surprised by the decison as they are now with PM Narendra Modi’s move. Prime Minister Narendra Modi on Tuesday announced the scrapping of high denomination currency, with an aim to curb black money.

Usually, high value notes are the basis of any form of corruption and illicit deals related to unaccounted money. According to a TOI report, the difference between that time and now is that in 1978, a Rs 1000 note could buy 5 sq ft of real estate space in south Bombay, but at this moment a Rs 500 note cannot even buy even a hundredth of a square foot in that area.-from FE

This Cartoon by R K Laxman in 1978 explains it all…