Linkfest:01 December,2016

Some stuff I am reading today morning:

10 stocks recommended by Porinju Veliyath (RJ)

Banks to be hit by Payday Cash Crunch Crush (FE)

Jets loaded with banned cash draw India’s ire (Bloomberg)

Analjit Singh buys more of Max Ventures (BL)

5 Reasons why NPAs will not come down anytime soon (MC)

Startup Valuation Markdowns explained (FirstPost)

50 Unfortunate truths about investing (BI)

The agony of investing in small caps (Common Sense)

Some advice for a would-be trader (MarketWatch)

Top 100 Financial Advisor Blogs (FeedSpot)

Portfolio of ChrysCapital

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

ChrysCapital is a well known PE major which invests via its investment arm Lavender Investments.

Its significant holdings in India as on 30 September,2016 as per Stock Exchanges is given below:

| Company Name | Symbol | Entity Name | Date End | # of Shares | % | Value (In Crores) |

| City Union Bank Limited | CUB | LAVENDER INVESTMENTS LTD | 201609 | 23608955 | 3.95 | 317.07 |

| Cyient Limited | CYIENT | LAVENDER INVESTMENTS LIMITED | 201609 | 4732101 | 4.2 | 231.78 |

| Hindustan Media Ventures Limited | HMVL | LAVENDER INVESTMENTS LIMITED | 201609 | 3050000 | 4.16 | 82.81 |

| IPCA Laboratories Limited | IPCALAB | Lavender Investments Limited | 201609 | 4989773 | 3.95 | 283.02 |

| Magma Fincorp Limited | MAGMA | LAVENDER INVESTMENTS LIMITED | 201609 | 18851431 | 7.96 | 196.24 |

| The South Indian Bank Limited | SOUTHBANK | LAVENDER INVESTMENTS LIMITED | 201609 | 38127000 | 2.82 | 80.26 |

| Torrent Pharmaceuticals Limited | TORNTPHARM | LAVENDER INVESTMENTS LIMITED | 201609 | 2445120 | 1.44 | 344.41 |

Biyani on Retail

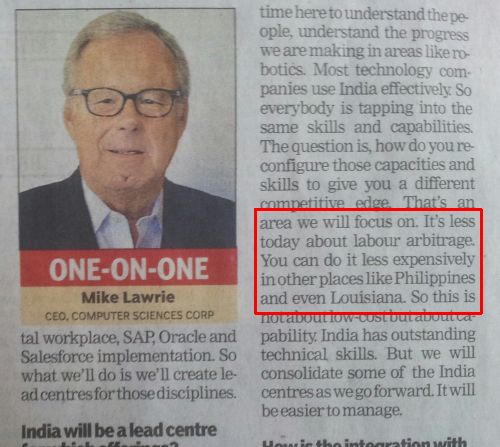

India IT low cost?Nah

Source: S Ketharaman