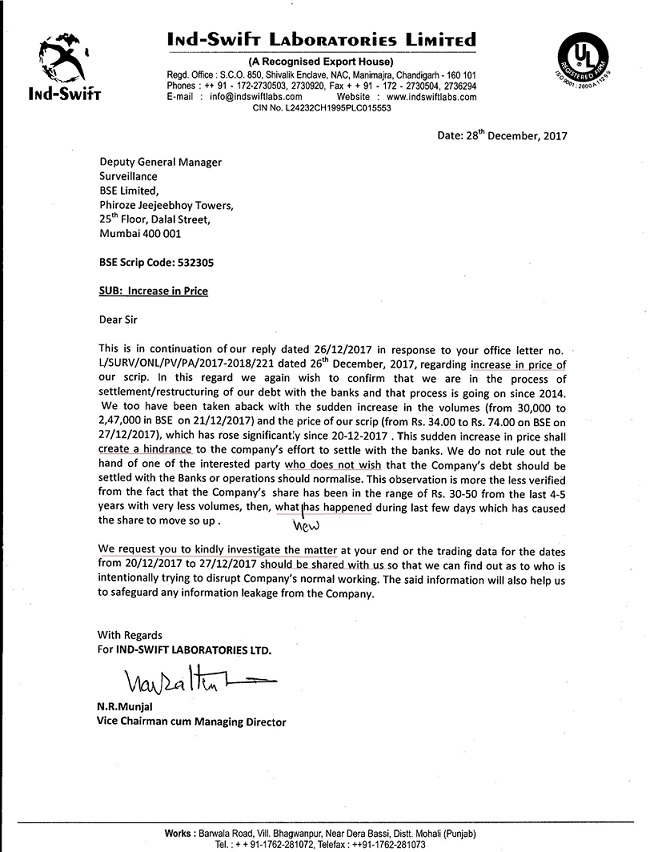

Amusing reply by Ind-Swift Labs to Bombay Stock Exchange which sought an explanation for unusual increase in stock price of the Company.

Linkfest: December 29,2017

Some stuff I am reading today morning:

Reliance Jio to buy RCom’s assets (Quint)

NITI Aayog’s plan to cut tax bill by $100 Billion (ET)

First cargo vessels on Brahmaputra to be flagged off today (Mint)

SEBI nod for universal exchanges (BS)

12 high conviction stocks for 2018 (Money Control)

The Amazon Machine (Ben Evans)

The digital advertising duopoly (A VC)

Are you day trading? (Seth Godin)

How to use the P/E ratio (Morningstar)

How to create next level wealth (Financial Samurai)

Chart: Sensex & Newsflow

Negative Working Capital Companies

Portfolio of Manoj Modi

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Manoj Modi is an well known entity in India Inc. He heads Reliance Retail and is a close confidant of Mukesh Ambani, India’s richest man.

His significant holdings as on 30 September,2017 as per stock exchanges is as given below:

| Company Name | Symbol | Entity | Value (In Crores) |

| Balkrishna Industries Ltd | BALKRISIND | Manoj H Modi | 878.38 |

| Balkrishna Paper Mills Ltd | BALKRISHNA | Manoj Modi | 3.79 |