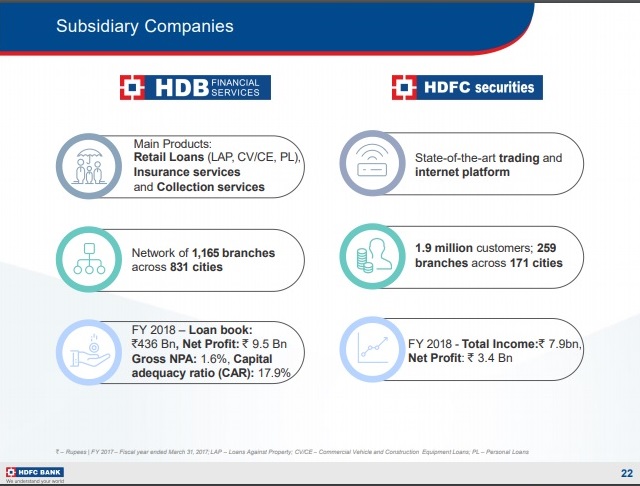

Delighted to see my unlisted babies shown on the Investor Deck of HDFC Bank

.@CNBCTV18News @CNBCTV18Live

I was observing 52 week high low list on NSE

52 week high : 11 scrips

52 week low. : 254 scrips

And market indices are near record highs again

Is this a bull market or bear market ?

Am very confused— Abhishek Kothari (@kothariabhishek) May 16, 2018

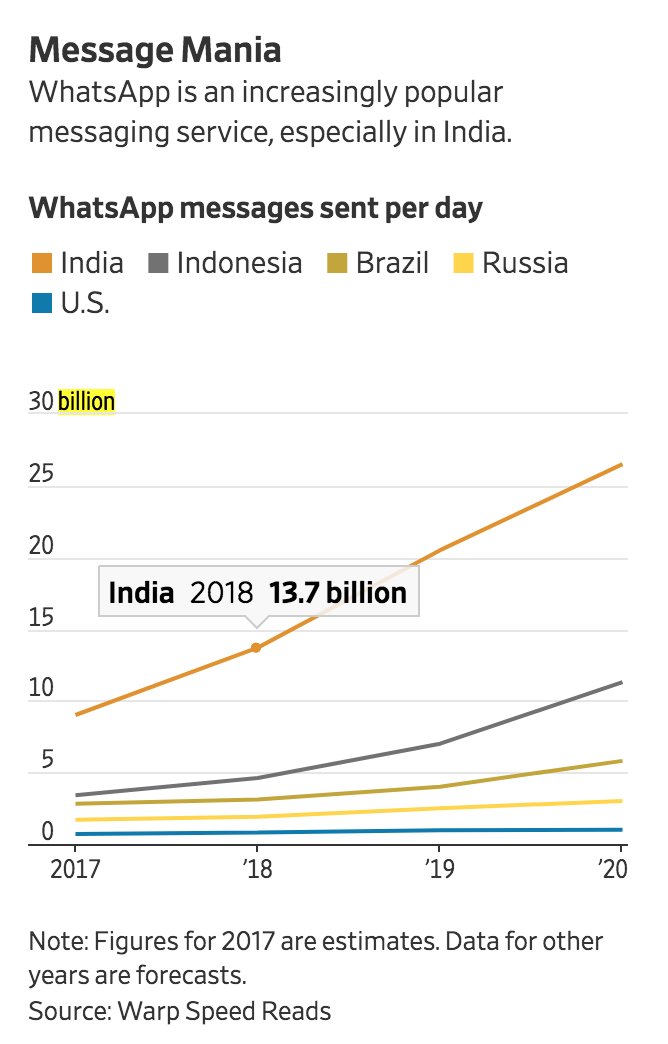

Chart: India’s WhatsApp Addiction

Source: James Crabtree

Linkfest: 16 May,2018

Some stuff I am reading today morning:

Arcelor Mittal clears 7000 Cr of Uttam Galva’s dues (MC)

Rupee is worst Asian currency of 2018 (Quint)

High profile exits at Mutual Funds (BS)

Contrasting performance of Indigo and Spicejet (Mint)

Interview with Sunil Subramaniam (BL)

Secret Diary of Ajay Piramal (OB)

Company Profile: Chaman Lal Setia Exports (OB)

Bakshi Ram-The man behind UP’s overflowing sugar mills (Rediff)

Debt is slavery-A reader’s story (Subramoney)

Why can’t fund managers admit mistakes? (BI)

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Vantage Equity Fund is a fund run by Kenneth Andrade’s firm Old Bridge Capital.

It’s investments as on 31 March,2018 as per Stock Exchanges is given below:

| Company Name | Symbol | Entity | Value (In Crores) |

| Clariant Chemicals (India) Ltd | CLNINDIA | Vantage Equity Fund | 14.03 |

| Indian Energy Exchange Ltd | IEX | VANTAGE EQUITY FUND | 48.8 |

| MacPower CNC Machines Ltd | MACPOWER | Vantage Equity Fund | 19.2 |

| Shakti Pumps (India) Ltd | SHAKTIPUMP | Vantage Equity Fund | 14.81 |