Categories

Some stuff I am reading today morning:

RIL becomes first pvt co to post 10,000 Cr Quarterly Profit (ET)

Why PSU stocks fail to deliver (MC)

Business leaders urge RBI to cut rates (Mint)

How ‘briefcase’ firms are robbing the Govt of GST (Rediff)

Shalimar Paints plans mega comeback (FC)

Brexit Plan ‘B’ (Reuters)

The Parlay (Semil Shah)

When your neighbors move into your investment portfolio (Jason)

Cash Management is about Stress Management (Financial Samurai)

Obituary: Jack Bogle-the greatest friend of Investors (TRB)

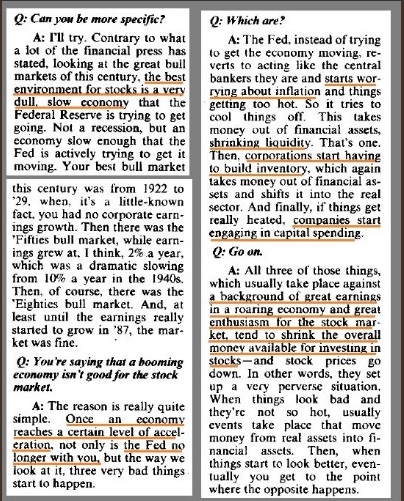

Source: NeckarCap