Buy a LIC policy. Save a PSU bank.

— R. Balakrishnan (@BalakrishnanR) February 22, 2016

Author: Raoji

Stocks for the long run?

Are equities always the best investment for the long run? It is the message that is usually sold to individual investors. The message is based on theory; equities are riskier than government bonds so should offer a higher return (the equity risk premium, in the jargon) to compensate investors. And the message seems to be borne out in practice, most of the time.

But there is an important caveat. Much of the data quoted by investment advisers is based on America, which is something of an outlier; it turned out to be the most successful economy of the 20th century but that was not guaranteed in advance. An investor in 1900 might have picked Germany as a rising power, only to see their assets wiped out in the 1920s hyperinflation and the Second World War; they might have picked Argentina, which was a perpetual disappointment. In other countries, there have been very long periods in which equities have not been a great investment.

Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School are the acknowledged experts on global investment returns, having compiled data covering 22 countries over more than a century. As of February 2013, the longest period of negative real returns from US equities was 16 years. But it was 19 years for global equities (and 37 for world ex-US), 22 for Britain, 51 for Japan, 55 for Germany and 66 for France. Such periods are much longer than most small investors would have the patience to wait.

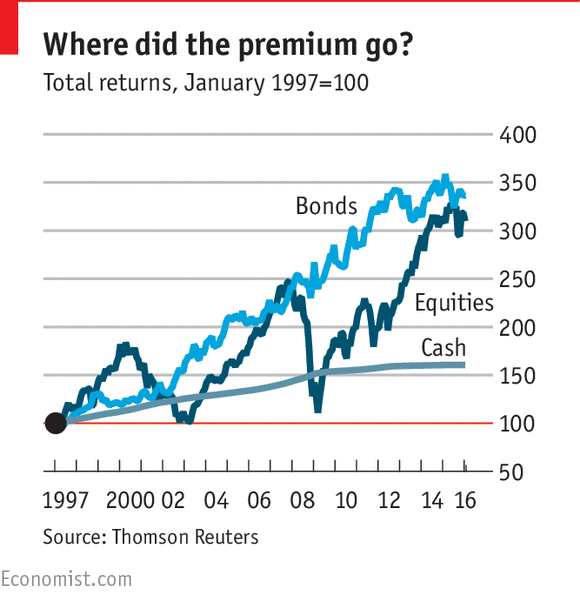

Another way of looking at the same issue is whether equities beat bonds over the long term; whether the risk premium is really delivered. This chart, a favourite of Albert Edwards of SocGen, shows the returns from equities (MSCI World, including dividends), long-dated government bonds (over 10-year maturity) and 3 months dollar cash since 1996. Bonds are still winning, even after the big recovery in equities since 2009.

from The Economist

Linkfest: February 22,2016

Some stuff I am reading today morning:

Agony in India’s dust bowl prompts Modi’s U Turn (Bloomberg)

How Indian Railways is using Twitter (ET)

Ratan Tata pushes for easing of 5/20 Rule (Mint)

A call to arms for reforms (Ajay Shah)

Ignore the negatives (Safir)

The ant and the grasshopper (Subramoney)

How Porinju escaped the carnage in Palred (RJ)

Iron Ore’s quiet comeback (Bloomberg)

How to make volatility your bitch (TRB)

Don’t buy winners (Swedroe)

Is this why @firstpost and @ibnlive have turned Bolshy? pic.twitter.com/stdvsNVL07

— কাঞ্চন গুপ্ত (@KanchanGupta) February 20, 2016

Weekend Mega Linkfest:18 February,2016

Some off beat reads for the long weekend:

Acing all Odds-The Leander Paes Way (Forbes)

The Mahabharata of Indian Internet Unicorns (Haresh Chawla)

Why I am against NewsX and TimesNow (Newslaundry)

Remembering the Indian Naval Mutiny (Scroll)

Kamlesh Tiwari Vs JNU (Op India)

Sheldon Adelson bets it all (Mother Jones)

China’s rich kids head West (New Yorker)

Preparing for the collapse of Saudi Arabia (Atlantic)

The Billion Year Wave (New Yorker)

How 21 year old Rohith is riding his Enfield to 46 Countries (YS)

How Manish Sharma lost his Startup and got it back (Mint)

11 Reasons why a Startup is like a girlfriend (Office Chai)

Secret language of hands in Indian Iconography (Smithsonian)

Maroosh-The West Asian QSR (Outlook)

Gossip: Splitsville and Money (FS)