Travelled more than 500 km through rural and semi-urban Rajasthan yesterday. Coke and Pepsi products available even in areas with no phone network. No sign of any products from the mythical desi beverage champion that claims to dominate these areas.

— Amit Mantri (@amitmantri) November 24, 2017

Author: Raoji

Linkfest: November 24, 2017

Some stuff I am reading today morning:

At 7%, bond yield puts market on edge (BL)

Insolvency Ordinance: Blunt, unforgiving and political (ET)

Lotte Confectionary to buy Havmor ice cream (Mint)

Avanti Feeds: Harvesting High Values (Forbes)

Tendulkar backed firm gets $ 100 Million Valuation (Quint)

David Swensen on Peer Pressure (CS)

Blackwater hired to torture Saudi Princes (Daily Sabah)

SocGen : Get out now (Zero Hedge)

What about the new XYZ fund? (Credo Capital)

How to earn regular income from Mutual Funds (MC)

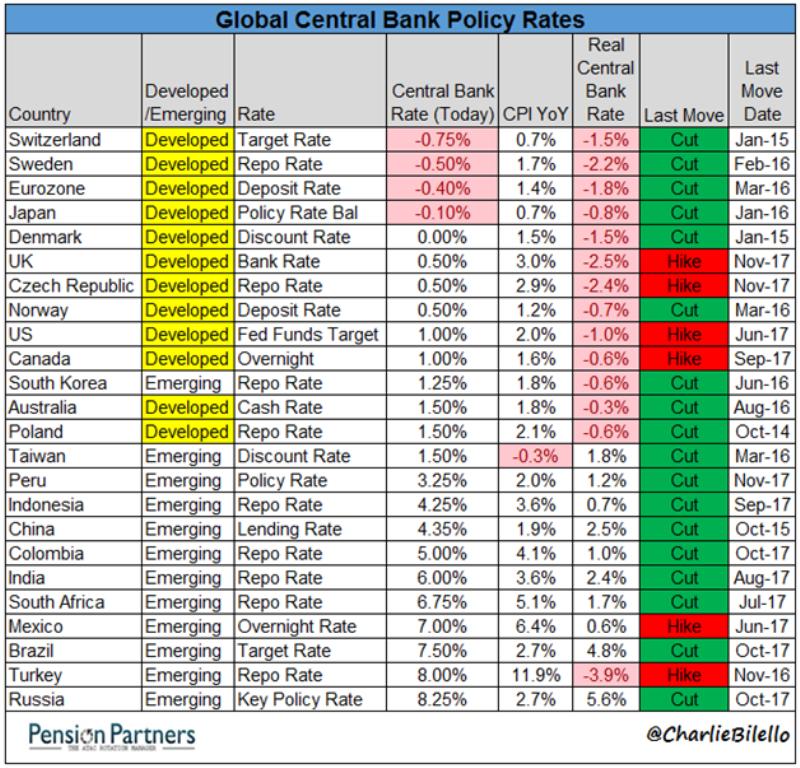

When Developed is Negative

Source: Pension Partners

Every developed country central bank in the world is maintaining negative real interest rates (easy monetary policies) 8 years into a global expansion

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

The Bank Muscat India Fund is a well known FII fund investing in the Indian Equity Markets.

It’s top 5 significant holdings as on 30 September,2017 as per stock exchanges is as given below:

| Company Name | NSE Symbol/BSE Code | Entity | Value (In Crores) |

| IIFL Holdings Ltd | IIFL | Bank Muscat India Fund | 773 |

| LIC Housing Finance Ltd | LICHSGFIN | BANK MUSCAT INDIA FUND | 693 |

| The Federal Bank Ltd | FEDERALBNK | BANK MUSCAT INDIA FUND | 376 |

| Shriram City Union Finance Ltd | SHRIRAMCIT | Bank Muscat India Fund | 190 |

| Magma Fincorp Ltd | MAGMA | BANK MUSCAT INDIA FUND | 146 |