Source: IIFL Research

Author: Raoji

Categories

Earnings Season Dress Code

Categories

Gaming the MSCI

#Vakrangeelimited #tilakfinance #kushaltradelink and a few others – What is the common link ? They topped out after entering the #MSCI index. Automated entry of Etfs and healthy exits for whom?

— Nooresh Merani (@nooreshtech) April 29, 2018

Categories

Linkfest: 30 April, 2018

Some stuff I am reading today morning:

Electrification of villages : India’s super achievement (Mint)

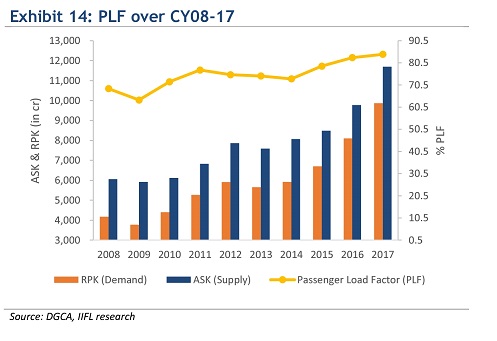

Indigo’s Aditya Ghosh and his Before Time departure (ET)

Why Air India has failed to find a suitor so far (Rediff)

Modi’s mega plan to boost digital transactions (BS)

Red alert: India stocks are now the priciest (BL)

Why MRF is Indian Stock Market’s peacock tail ? (Money Life)

More Questions about ICICI Pru’s Bharat 22 investments (MFCritic)

Growth Vs Value-A Trillion $ Debate (Pi Online)

Happiness and the Gorilla (Scott Galloway)

An unconventional take on success (Stephanie Denning)

Categories

Top Clicks on Alpha Ideas This Week

Here are the most clicked items on Alpha Ideas this week:

Fishy report on Avanti Feeds (AI)

Vikas Oberoi: Why realty prices won’t come down (AI)

Notes from the 2nd Sohn India Conference (AI)

Notes from the 1st Sohn India Conference (AI)

Annual Letter to Shareholders (Vallum Capital)

Domino’s cheese controversy intensifies (Forbes)

Godha Carbon: Only 71% of revenues (AI)

Lucky millionaires (Subramoney)

Who tipped businessmen about Nanar refinery project? (Rediff)

How 3% yields could reshape the investing landscape (Quint)