Categories

Author: Raoji

Categories

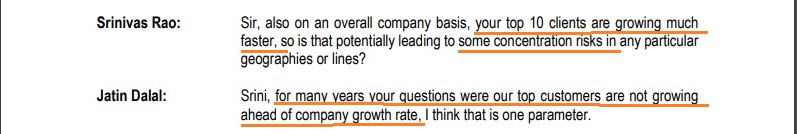

Wipro: You Can’t Win

Categories

Linkfest: 14 August, 2018

Some stuff I am reading today morning:

Rupee slides to lowest ever close (FE)

CVoter Survey predicts BJP loss in all 3 states (Quint)

Interview with Sanjeev Prasad (MC)

Interview with Udayan Mukherjee (MC)

Money lessons from a 89 year old investor (Uma Sashikant)

Wine makers struggle to uncork sales (Mint)

Investing – Picking Themes (Bala)

8 Questions I’ve been pondering (Common Sense)

What happens in Turkey won’t stay in Turkey (CNBC)

Strike when the iron is hot (A VC)

Categories

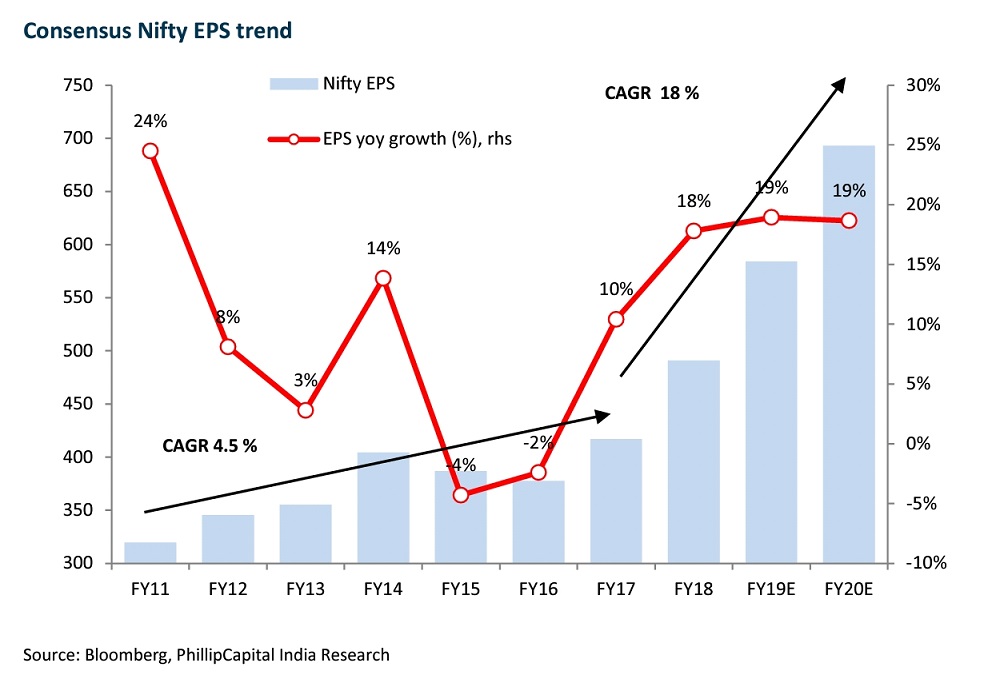

Chart: Nifty EPS

Categories

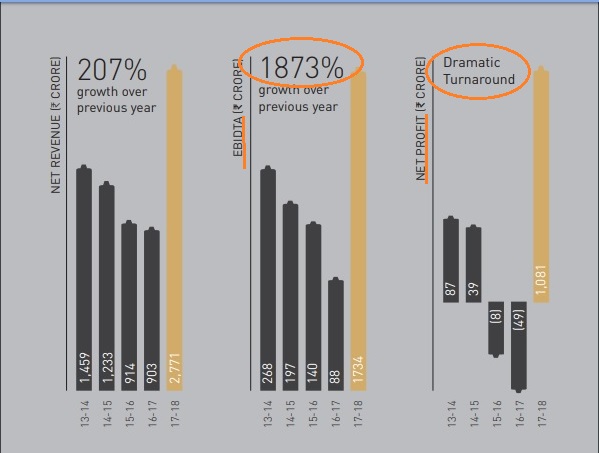

What a Commodity Boom looks like

Source: Annual Report of HEG Ltd 2017-18