Author: Raoji

How many of train travellers in Mumbai get their shoes shined at the railway station before going to office?

The shoeshine boy squats on barely two square feet of real estate.

He doesn’t “own” it, but rents it.

Often, the rent is between Rs 100 to Rs 200 a day.

Assuming 300 working days, it could be at a minimum Rs 30,000 for two square feet per year.

The rental yield is usually low (around 5 per cent), but even assuming 10 per cent, that translates into capital value of Rs 3 lakh, or Rs 1.5 lakh per square foot.

This price exceeds even the most expensive neighbourhoods of Mumbai, including Pedder Road or Nepean Sea Road.

The strange fact is that the shoeshine boy occupies very expensive real estate even though he is close to the (income) poverty line.

–wrote Ajit Ranade

Linkfest: December 27,2017

Some stuff I am reading today morning:

Sliding GST earnings may put pressure on Govt (Mint)

RCom’s debt reduction plan (Quint)

Interview with Raamdeo Agrawal (ET)

How fund managers fared in 2017 (BL)

Nifty target of 20,00 by…. (Vijay Pahwa)

In the world of ‘Yo Yo Funds’ (MF Critic)

‘Weird’ Economics explained (Ajit Ranade)

Who destroyed D S Kulkarni Developers ? (Ravi)

50 Phrases to run from (TRB)

David Rockefeller and the largest art auction of all time (VF)

GNFC Shareholders: Time for caution?

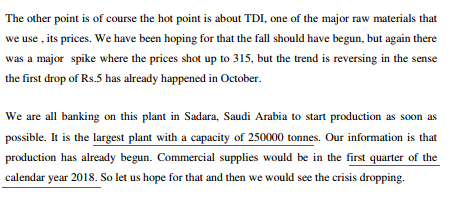

GNFC is the largest producer of Toulene Di-Isocyanate (TDI) in India with a production capacity of 65,000 tonnes per annum

As TDI prices have soared, so has the Company’s revenues and profits resulting in the stock price increasing by 5x in the last two years.

Conversely,consumers of TDI have borne the brunt of the price increase.

Now as the conference call transcripts of Sheela Foam indicates, a relief for them is around the corner.

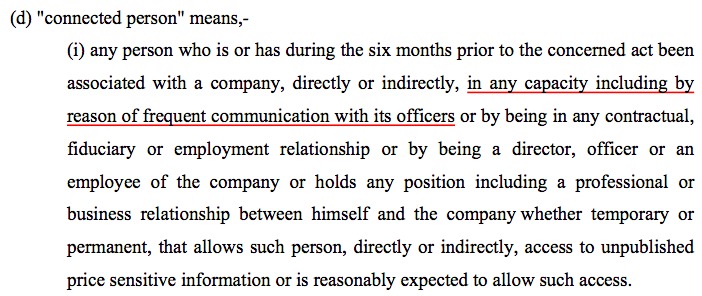

SEBI as a Mutual Fund Risk Factor

Hat Tip: Deepak Kapur

From SEBI (Prohibition of Insider Trading) Regulations,2015

If SEBI were to actually implement this, most of Dalal Street’s finest-including MF Fund Managers,PMS Managers,Research Analysts etc-will be behind bars.