Categories

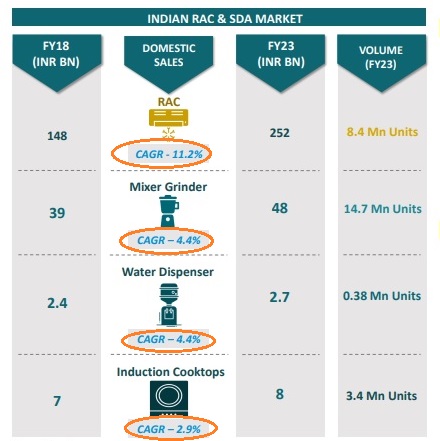

India RAC & SDA Market

Source: Investor Presentation of EPACK Durable Ltd

RAC- Room Air Conditioners

SDA- Small Domestic Appliances

Categories

Linkfest: 12 April, 2024

Some stuff I am reading today morning:

India-Mauritius amend tax treaty (NDTV Profit)

India household savings plummet to record lows (BW)

IPOs in FY25 can hit 1 Lakh Crores (Rediff)

The Phalodi Satta Bazaar (FE)

China reacts to PM Modi’s comments (BT)

10 ways Iran can attack Israel (Jerusalem Post)

Costco’s Gold Bar Bonanza (Oil Price)

Bitcoin can hit $1 Million (The Street)

Buffett: Holding on to losers (AM)

CEO Letter to Shareholders (Jamie Dimon)

Categories

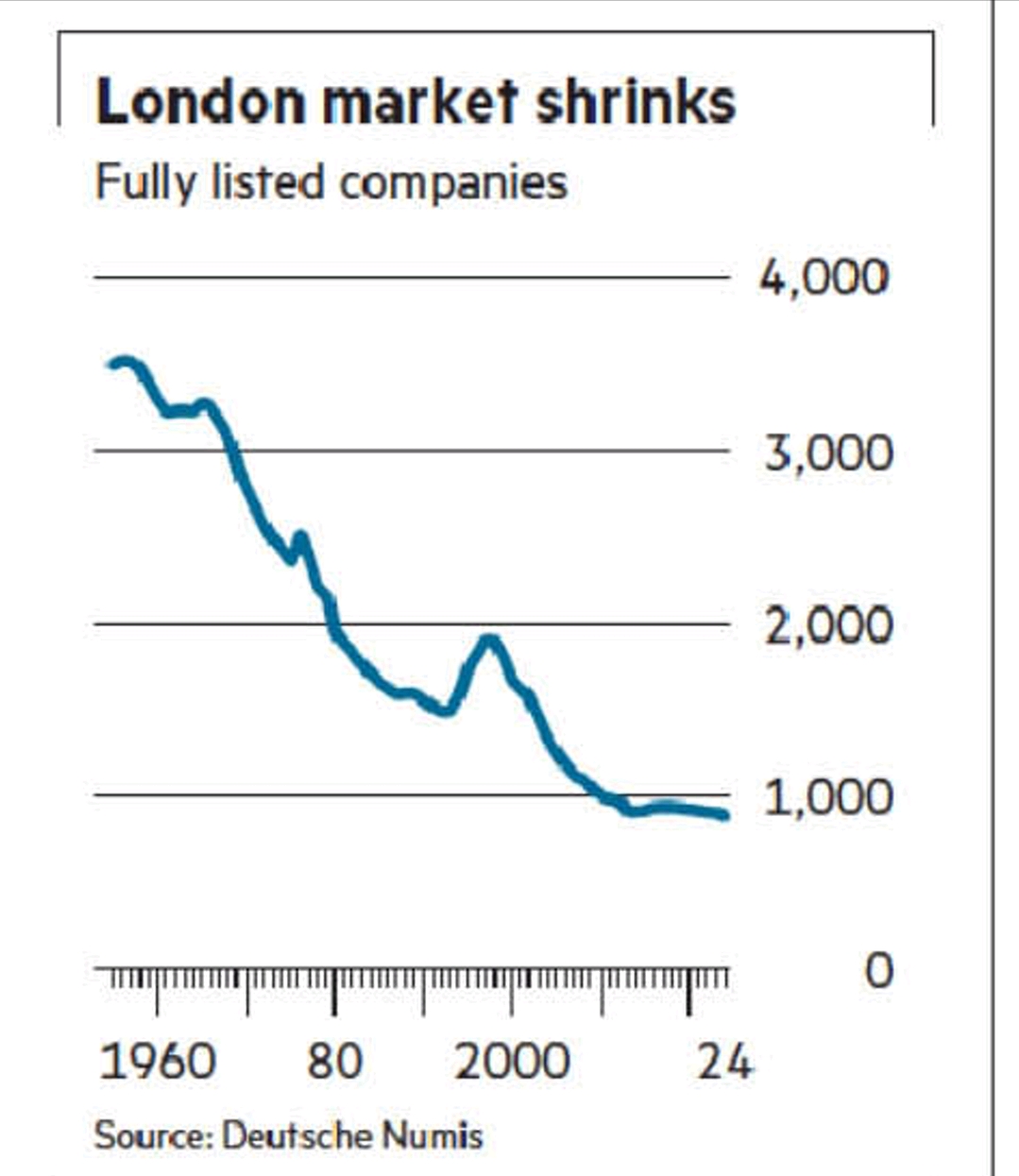

London has fallen

Categories