Categories

Categories

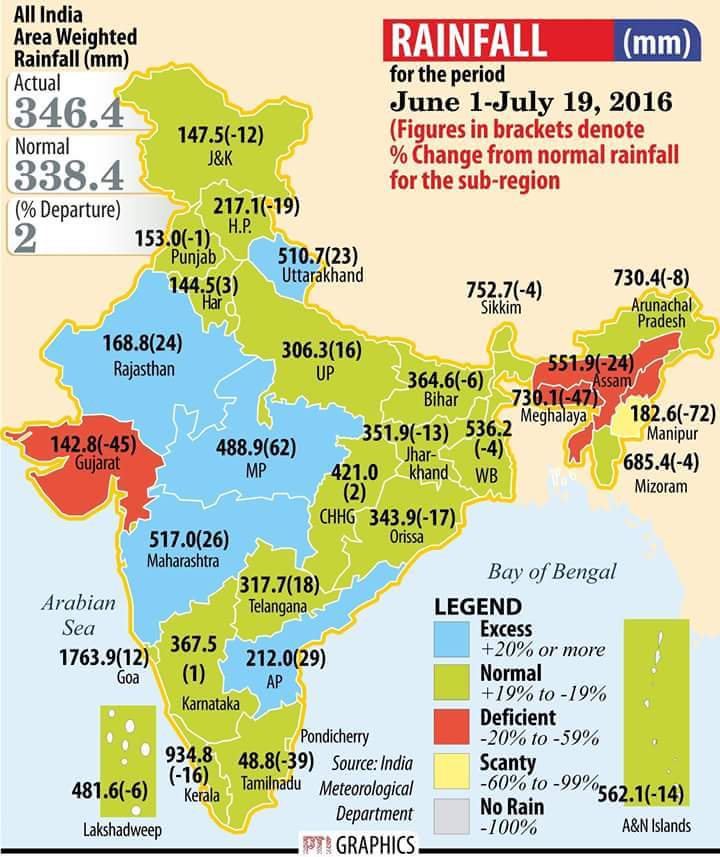

Chart:Monsoon so far

Hat Tip: Kiran

Categories

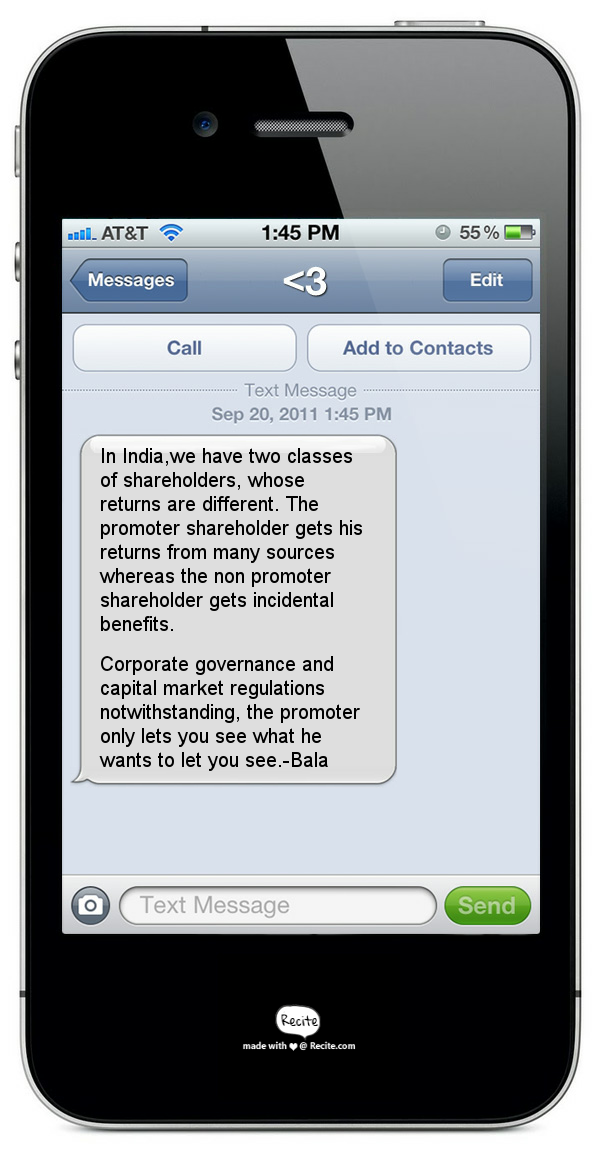

Class determines Returns

Categories

Linkfest: July 20,2016

Some stuff I am reading today morning:

IPO Review:Advanced Enzyme Tech opens today (BL)

Parag Thakkar’s stock picks (ET)

Govt. to infuse Rs.22,915 Crores in 13 PSU Banks (Mint)

GM food can solve India’s pulses problem (Bloomberg)

Value Investing-A dead end? (Bala)

Beware of lifestyle creep ! (Subramoney)

Uncovering alpha in micro caps (Value Walk)

Academic Finance as a check on pretensions (CFA Institute)

Trailing or Forward Earnings? (CFA Institute)

Why are investors so tribal? (Tony Isola)

Categories

Oh Ricoh !

(Got this as a WhatsApp Forward)

Ricoh reported turnover of Rs.1637 Cr in FY15

New Mgmt says loss for FY2016 is Rs.1120 Cr

This is extent to which accounts can be manipulated