Very interesting presentation on India Cement

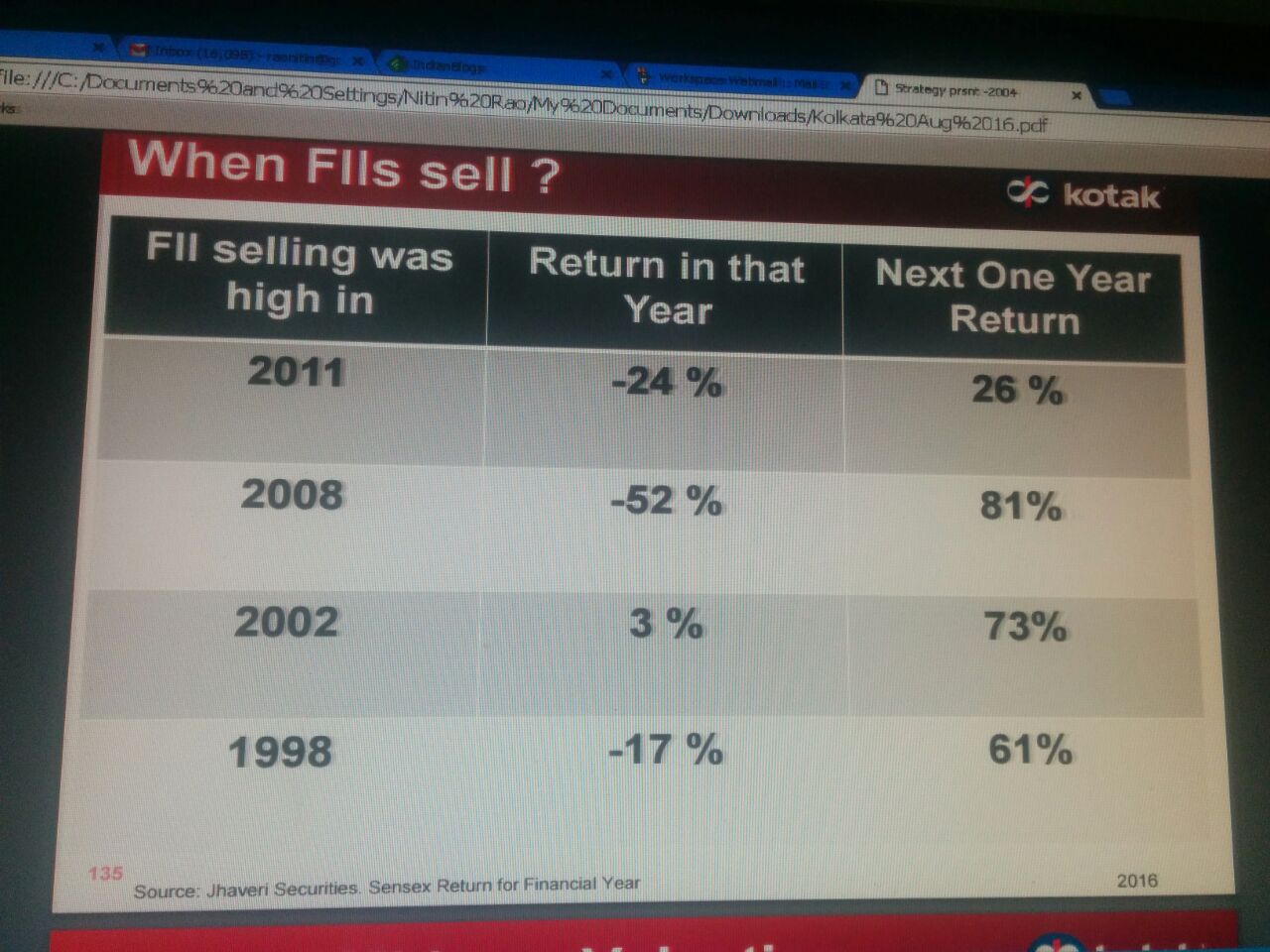

When FIIs sell ?

Linkfest:Nov 29,2016

Some stuff I am reading today morning:

Modi’s Choice: Pay 50% else 85% (Mint)

Rural Downturn (BL)

Sheela Foam IPO opens today (FirstChoice IPO)

Here’s what Modi will do next (Forbes)

Decoding Modi’s political calculations (ET)

Interview with Udayan Mukherjee (Money Control)

The costliest mistake investors make (Irrelevant Investor)

These charts explain the EM selloff (ValueWalk)

Upto 8 Italian Banks may fail if Renzi loses referendum (ZeroHedge)

Efficiency is the highest form of beauty (Mr.Money Mustache)

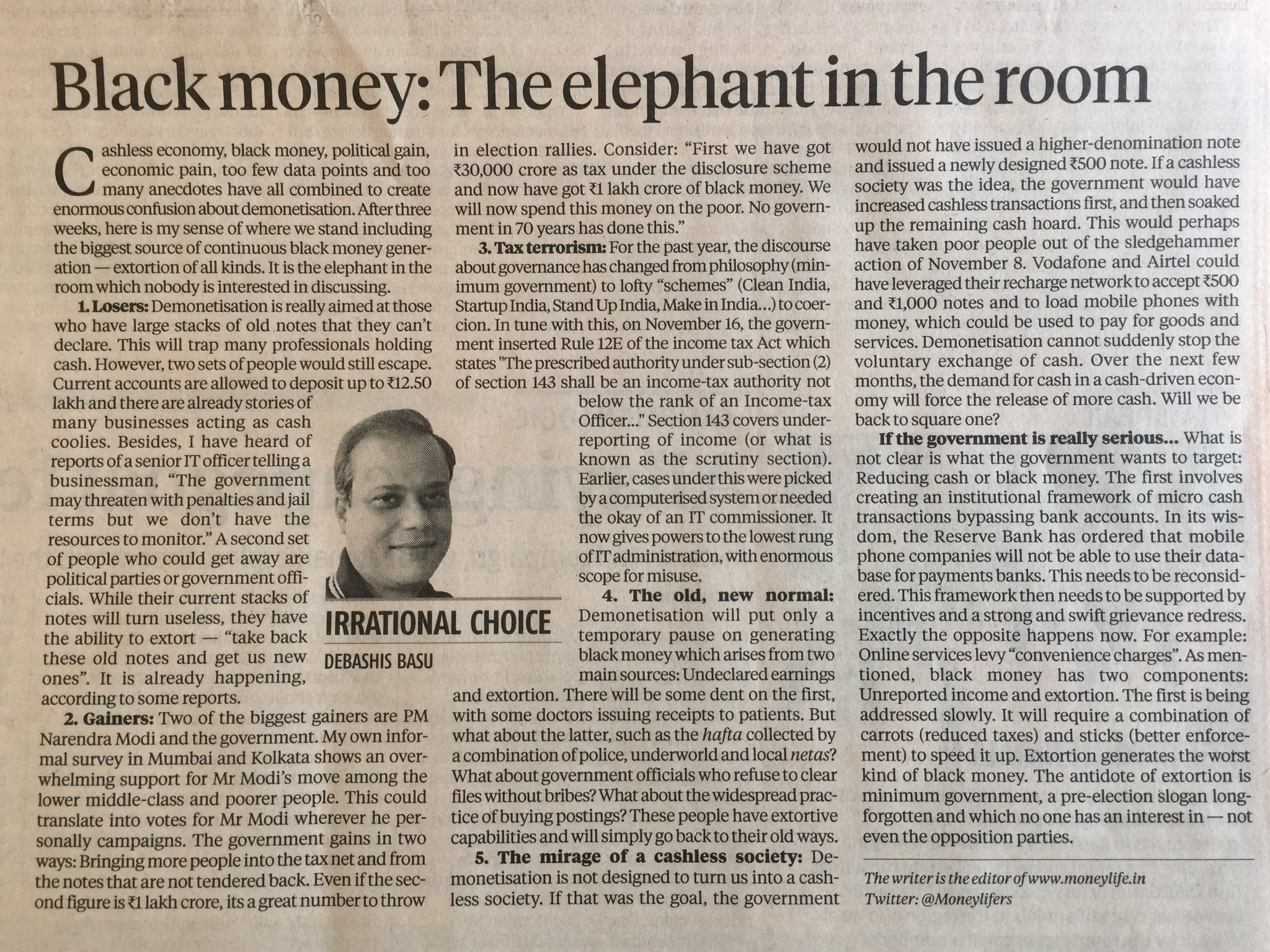

Beware of the Taxman’s Wrath

Amid the panic and confusion caused by India’s ban on 86 percent of cash in circulation, there’s hope that the pain in the stock market won’t last beyond a quarter or two, and that everything will be hunky-dory once banks have dispensed enough new notes.

What if that optimism was unfounded?

Suppose that by the end of the year fund inflows double from the $75 billion already taken in by Indian lenders between Nov. 10 and Nov. 18. That would mean a return to the banking system of $150 billion, or roughly the entire stock of high-denomination cash held by the public before the ban.

To Modi’s government, that would signify an embarrassing win for money launderers’ shenanigans. If authorities respond by registering tax claims on a fifth of new deposits — in proportion to the government’s own estimates of the size of the parallel economy — then up to $30 billion of money coming into banks could be immobilized by disputes.

Even if all of it is ill-gotten, the signal such a large expropriation would send to other wealth owners could have a chilling effect on conspicuous consumption as well as purchase of new property

The taxman’s wrath, which would reveal itself only after the deposit surge tapers off, is yet to figure in investors’ calculations.-wrote Andy Mukherjee