Example of Intense Speculation & synchronized Operations – Moved fm 78 to 240 to 139. As retail swarms the mkt -this list is bound to expand pic.twitter.com/2B4ym5bely

— Ambareesh Baliga (@ambareeshbaliga) May 3, 2017

Steel, Sikka Aur Gana

Hat Tip- Sagar Karkhanis

From National Steel Policy, 2012

Major Objective of the Steel Policy, 2012:

To attract investments in Indian steel sector from both domestic and foreign sources and facilitate speedy implementation of investment intentions on board so far so as to reach crude steel capacity level of 300 million tonnes by 2025‐26 to meet the domestic demand fully.

A full 5 years later.

From National Steel Policy, 2017

Objective of the Steel Policy, 2017:

Build a globally competitive industry with a crude steel capacity of 300 MT by 2030-31

So the objectives are the same, the dates keep changing.

The Ministry of Steel seems to be learning from Vishal Sikka, the CEO of Infosys on being asked whether Infosys will meet the stated target of $ 20 Billion by 2020 replied:

It’s an aspiration. We established something to galvanise people’s attention around. This is not a target or a goal. We are barely $10.2 billion now.

The song these fine folks seem to be inspired by is:

“Hum Honge Kamyaab,

Hum Honge Kamyaab,

Man mein hai vishwas,

Poora hai vishwas,

Hum Honge Kamyaab,

Ek Din”

Just don’t ask when that day will come.

Linkfest: May 04,2017

Some stuff I am reading today morning:

What IRB’s InvIT IPO offers investors (Quint)

IPO Analysis: HUDCO (SP Tulsian)

Cabinet clears ordinance to tackle NPAs (Mint)

Essar MD, Mumbai IT Commissioner arrested (MC)

Two sectors that will make money (Motilal Oswal)

Why are so many houses vacant in India? (Ajay Shah)

India’s Silicon Valley is dying of thirst (Wired)

Mercedes-Benz in India (Forbes)

Startup Story: Fingerlix (OB)

The great Vanilla shortage of 2017 (Climateer)

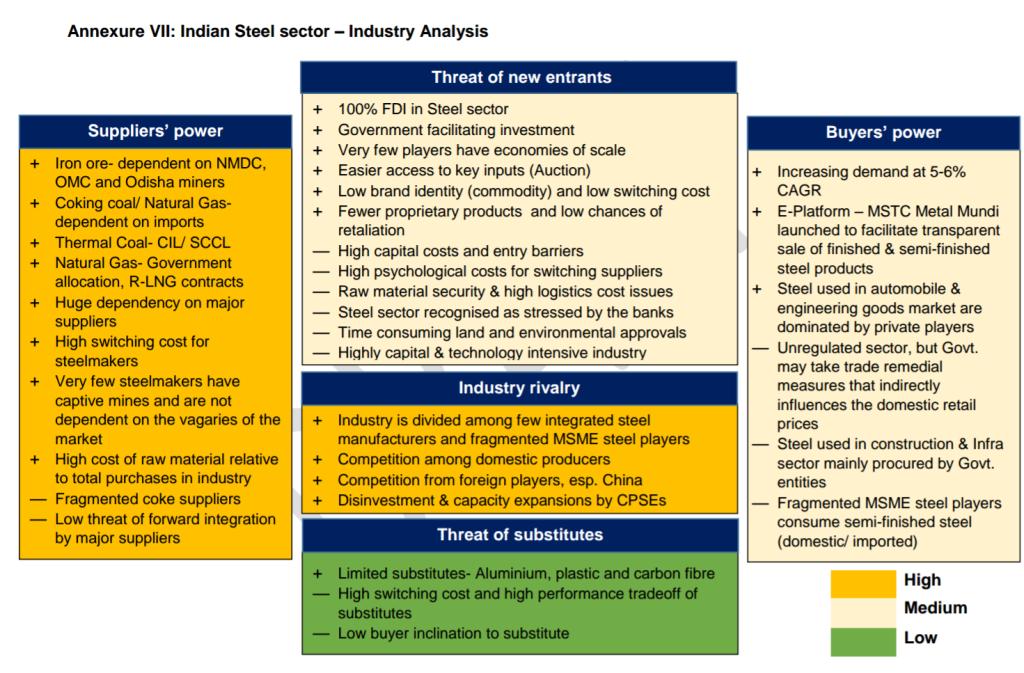

India Steel : Industry Analysis

Portfolio of Kanchan Sunil Singhania

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Kanchan Sunil Singhania is the better half of Sunil Singhania, CIO,-Equity, Reliance Mutual Fund

Her investments in her personal capacity as on 31 March,2017 as per Stock Exchanges is given below:

| Company Name | NSE Symbol/BSE Code | Entity | % | Value (In Crores) |

| Cambridge Technology Enterprises Ltd | CTE | KANCHAN SUNIL SINGHANIA | 1.45 | 2.45 |

| Sunil Healthcare Ltd | 537253 | KANCHAN SUNIL SINGHANIA | 2.87 | 2.76 |