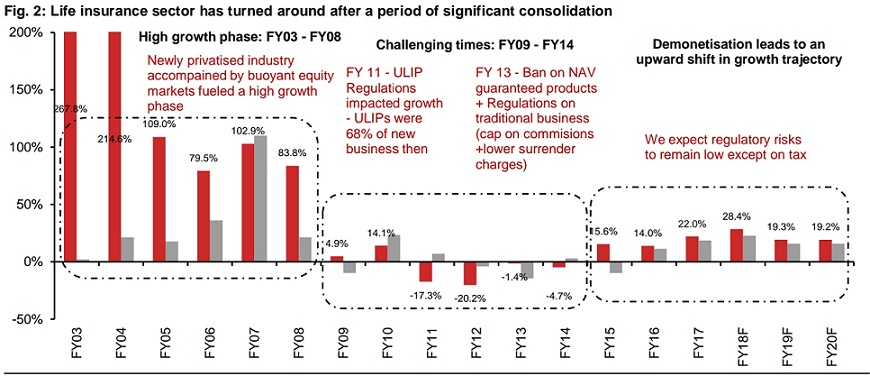

Source: Nomura Research Report on Life Insurance

Top 5 Holdings of Haresh Keswani

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Haresh Keswani is a well known investor in the Indian Equity Markets.

His significant holdings as on 30 September,2017 as per stock exchanges is as given below:

| Company Name | NSE Symbol/BSE Code | Entity | Value (In Crores) |

| Kama Holdings Ltd | 532468 | Keswani Haresh | 119.65 |

| Polyplex Corporation Ltd | POLYPLEX | KESWANI HARESH | 80.52 |

| Uflex Ltd | UFLEX | Keswani Haresh | 80.17 |

| Nalwa Sons Investments Ltd | NSIL | Keswani Haresh | 42.3 |

| Deccan Cements Ltd | DECCANCE | KESWANI HARESH | 37.52 |

Linkfest: January 05, 2018

Some stuff I am reading today morning:

Crude Oil at $68 (ET)

Dow 25,000 (TRB)

Mutual Fund assets to hit Rs.100 Trillion in next 10 years (BS)

Another hare brained idea by SEBI (MC)

Bajaj Vs Bajaj-A tale of two brothers (Quint)

Indian Banking Sector-The Last Decade (Dhruv Saraf)

My Stock Pick for 2018-Jyothy Labs (Ambareesh Baliga)

Why doctors are not rich (Subramoney)

When Berkshire buys Hershey (DR)

Ripple CEO now richer than Zuckerberg (Zero Hedge)

RCom: Kya Hua Tera Vaada?

Source: RCom Annual Report 2011-12