Some stuff I am reading today morning:

Nation mourns Atal Bihari Vajpayee (TOI)

Amazon’s real rival in India is Reliance (ET)

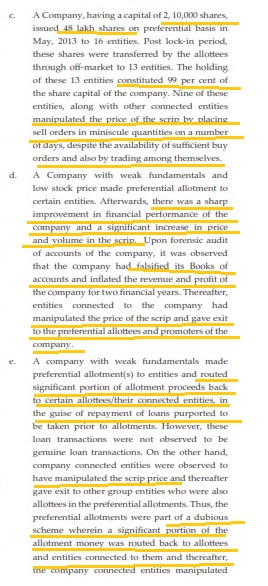

Top NSE officials facilitate fraud (Quint)

Banking Sector: A private affair (Vivek Kaul)

Understanding how the Indian sugar industry works (Alpha Invesco)

Deja Vu in Turkey (Aswath Damodaran)

The trajectory of great ideas (Morgan Housel)

The half life of investment strategies (Common Sense)

Simple analysis for pricing (Seth Godin)

A conversation with David Swensen (CFR)