One of the landmark achievements of Indian democracy was the integration of various princely states within it without much bloodshed.

In fact,once the Soviet Premier Khrushchev commented “It’s remarkable how India has managed to liquidate the Princely states without liquidating the Princes”

One of the main reasons why the Princes went quietly was the promise of the Privy Purse…a regular pension paid to them and their families by the Govt of India.

After some years,the Govt of India, under the leadership of Indira Gandhi went back on its word and abolised the Privy Purse.

The case went to Court and there the great Nani Palkhivala made the following argument:“The survival of our democracy and the unity and integrity of the nation depend upon the realisation that constitutional morality is no less essential than constitutional legality. Dharma (righteousness; sense of public duty or virtue) lives in the hearts of public men; when it dies there, no Constitution, no law, no amendment, can save it.”

Fast forward to the present.

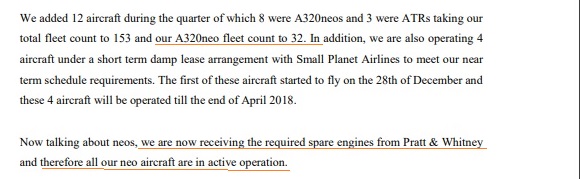

In 2004,Chidambaram did away with LTCG in his budget stating the following:

Capital gains tax is another vexed issue. When applied to capital market transactions, the issue becomes more complex. Questions have been raised about the definitions of long-term and short-term, and the differential tax treatment meted to the two kinds of gains. There are no easy answers, but I have decided to make a beginning by revamping taxes on securities transactions. Our founding fathers had wisely included entry 90 in the Union List in the Seventh Schedule of the Constitution of India. Taking a

cue from that entry, I propose to abolish the tax on long-term capital gains from securities transactions altogether. Instead, I propose to levy a small tax on transactions in securities on stock exchanges

Note the word instead.It was both an implicit and explicit promise to the people of India.

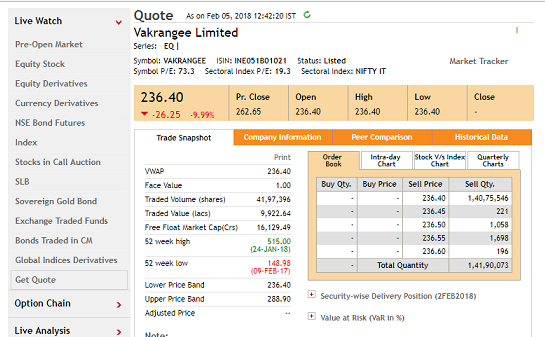

Now,we have Arun Jaitley as the Finance Minister breaking this promise by bringing back the LTCG but not scrapping the STT !!

Have you no sense of Dharma, Mr.Jaitley?