Source: Oaklane Capital Management

Source: Oaklane Capital Management

Some stuff I am reading today morning:

EU & UK reach deal on Brexit (BBC)

Realty market sentimernts sink to demonetization levels (ET)

Health of MSMEs worsens (BS)

India’s tightrope act with foreign investors (Mint)

SEBI may hike PMS investment limit to 50L (MC)

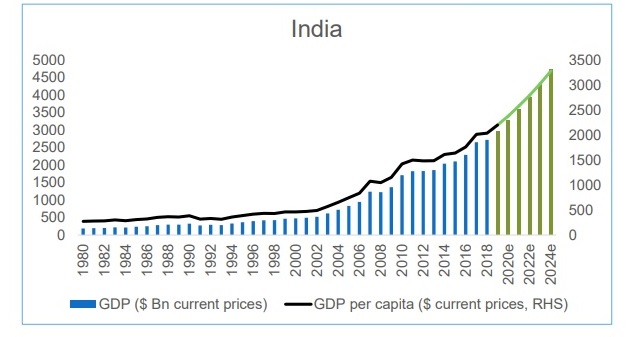

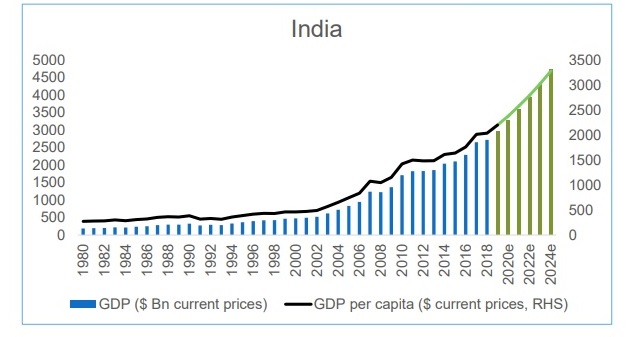

India: Wealth Creation Story (Kuntal Shah)

The smelting of Indian stocks (Calm Investor)

Latest Memo from Howard Marks (Oaktree Capital)

Forget Value Vs Growth (Michael Mauboussin)

An Eulogy for the 60-40 portfolio (Common Sense)