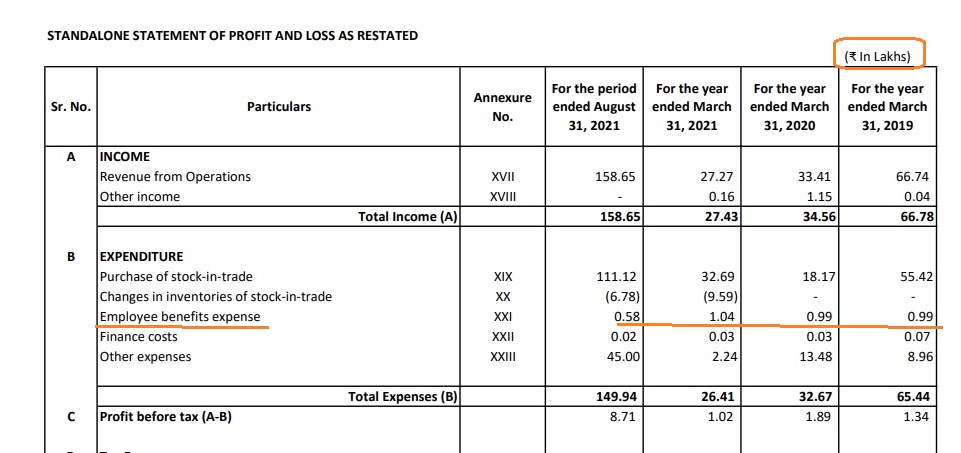

Source: Draft Prospectus of Achyut Healthcare Ltd

Amusing to see a prospectus with around a lakh in employee expenses.

Also interesting to note their HR promise.

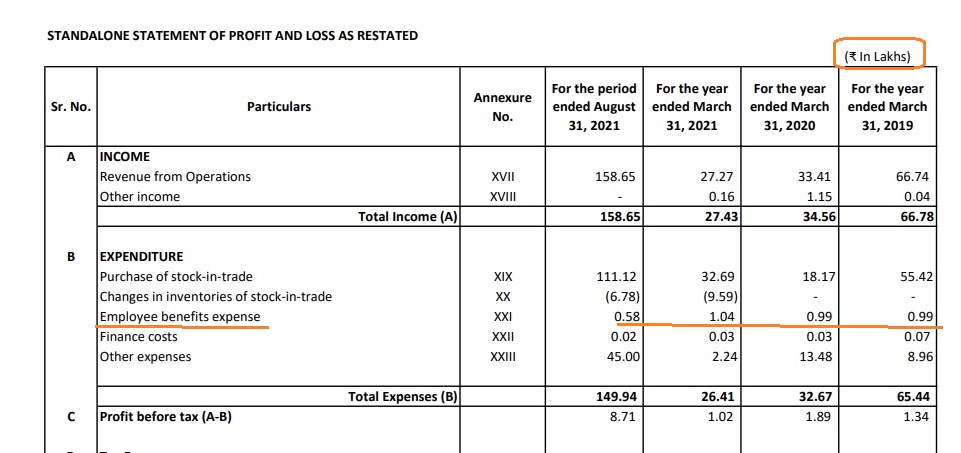

Source: Draft Prospectus of Achyut Healthcare Ltd

Amusing to see a prospectus with around a lakh in employee expenses.

Also interesting to note their HR promise.

Source: Zomato Blog

Some stuff I am reading today morning:

86% of Farmer Groups supported Farm Laws (BS)

New Crypto tax clarification will kill Crypto in India (MC)

RBI: No chance of India falling into stagflation (Rediff)

Ruchi Soya OFS from March 24 (CNBC)

Tangshan, China’s biggest steel centre, affected by Covid (GT)

Maruti’s EV plans (Forbes)

Stock Talk: Piramal Enterprises (Ventura)

Market reaction to Russia-Ukraine War (Aswath Damodaran)

Keeping it simple (A VC)

Unbundling advertising (Ben Evans)