When I had money, I had a good life. When I lost it all, life started to suck.

And 12 years later, life still sucks.

I never had millions – I was just very comfortable. I had a decent apartment, a good wife, enough money to take four vacations a year and all of the toys that I could reasonably have wanted.

But it all went in 2000 when I trusted the wrong person to be General Manager of my company. He got greedy, started stealing money from the company and kept on stealing until it sent the company under.

I wasn’t too worried when it happened initially. I had lost a business before and was able to start a second one immediately afterwards which was even more successful, I thought that it shouldn’t be too much of a problem to do it all again as I was bright and prepared to work hard and was a firm believer in “the harder you work, the luckier you get”.

But I was wrong.

I sunk my life savings into a new business venture that didn’t come off and so had to move back in with my parents while I searched for a job. I thought that it should not be too much of a problem finding a ‘real job’, but I was wrong. I found out the hard way that employers are nervous about hiring anyone who has been self-employed for a decade – especially those without any very specific skills.

So for most of the last decade since I lost everything, I have had to survive on starting small business of my own with no capital behind me. Since then I have been barely scraping a living and have continually had problems with getting screwed over by more partners. My wife stood by me for the first couple of years of having no money, but she got impatient after a while and divorced me. I’ve been single for most of the decade as I haven’t been able to support myself let alone anyone else.

I really don’t know how I would have survived without my parents coming to the rescue on numerous occasions – providing me with somewhere to live when it all went wrong again, and unsecured loans to get me through the bad patches until I am able to settle my debts and start again.

If I had to summarize what it feels like to lose all your wealth in one sentence, I would say that it feels like being involved in an accident where you end up being partially paralyzed. You spend the rest of your life thinking back on the event, wondering if you could have avoided it somehow, feeling sorry for yourself that life is never going to be as good as it was again and feeling nostalgia for the times when life was good.

It’s the flipside to the American Dream that doesn’t get much exposure. History is written by the victors, so we usually only get to read the stories of those that went from rags to riches, rather than those who took the journey in the opposite direction.

I will agree though that there have been some upsides along the way. I remember a line from Fight Club – “you don’t own your possessions; your possessions own you.” This I have found to be true. I don’t regret losing all my toys. It is very liberating to know that you can fit your entire worldly possessions into a suitcase, hop on a plane and start all over again.

“Freedom is just another word for nothing left to lose.”

I’ve also had some pretty exciting adventures over the last decade – living in four different countries on three continents and have been involved in setting up a whole host of different businesses in completely different fields – a far more interesting life than had I just lived a moderate middle class life owning a moderately successful business.

But, if I had the chance to live my life all over again, I’d change most of it.

-By Nick Pendrell in Quora

Author: Raoji

The happy secret to better work

Weekend Mega Linkfest:March 15,2013

Some interesting off beat reads for the weekend:

BRICS abandoned by local investors (Bloomberg)

Rajnath uncovers Vedic roots of quantum mechanics (Open)

Mother Teresa did not deserve the Nobel (Outlook)

Why Bollywood aspirants chase Shanoo Sharma (Caravan)

Italian slap and Indian fickle (Newslaundry)

Penalty for paying credit card dues by cheque (Moneylife)

Revival of insurgency in J&K (IDR)

Portraits of Russia’s most successful women (Slate)

Profile of Malala Yousafzai (VanityFair)

Ideas are dime a dozen, people who implement them are priceless (Forbes)

Pope Francis and the dirty war (NewYorker)

10 countries with the fastest growing tourism (Marketwatch)

The battle for Bangladesh (ForeignAffairs)

Looking for India’s Zuckerberg (Economist)

Waiting for the Accelerator bubble to pop (Businessweek)

Are restaurants justified in charging service charge? (MumbaiBoss)

How I delivered my first order (Rodinhoods)

Not just videos, upload your photos on Youtube (Labnol)

Obama in Israel’s new world (ProjectSyndicate)

Photolog: Aamchi Mumbai (TeamBHP)

The Big Short War-Battle of the Billionaires (VanityFair)

The history of blue jeans (VICE)

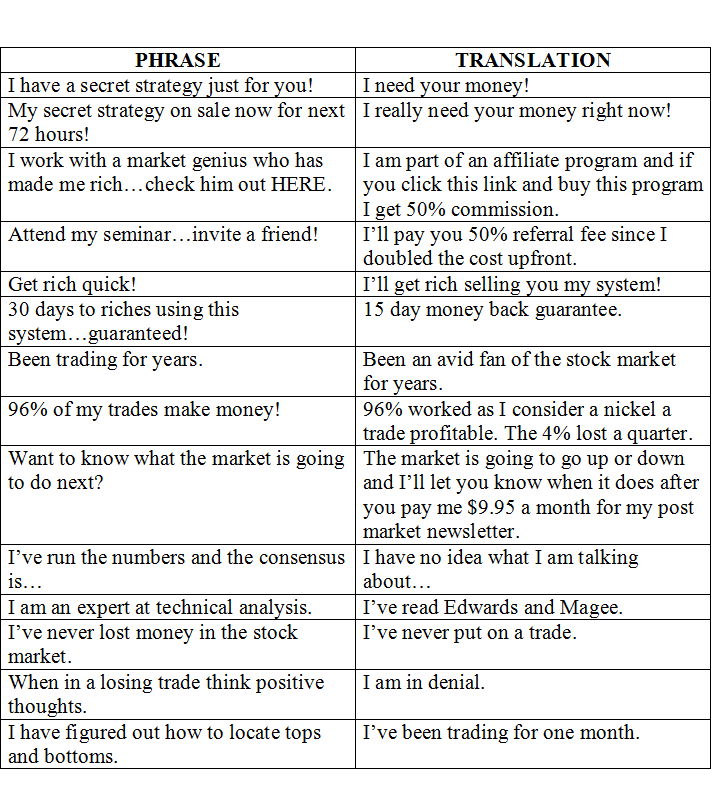

What tipsters say and what they mean

5 stocks whose buyback is currently on

This post is in continuation of my 5 Stocks series (see here)

5 Stocks whose buyback is currently on (as on March 15,2013) are:

- FDC Ltd

- Vardhman Acrylics

- ECE Industries

- Sasken Communications

- Rain Commodities