The market pays a premium for simple stories. Stay away from the onions where you have to peel back multiple layers to understand them.

— MicroCapClub (@iancassel) June 17, 2015

Author: Raoji

Categories

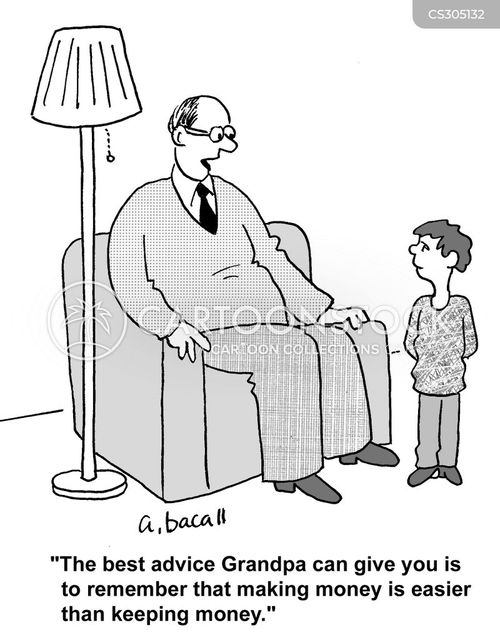

The Biggest Wealth Destructors in India

Source: Prashant

Categories

Linkfest:June 17,2015

Some stuff I am reading today morning:

Goldman Sachs is forecasting two Fed rate hikes in 2015 (Value Walk)

Luxury flats unsold in Mumbai (FE)

Investors shift to tax free bonds (ET)

Power glut leaves gencos powerless (FE)

Interview with Prof. Sanjay Bakshi (Microcap Club)

What if your fund manager quits (FreeFinCal)

Motilal Oswal Research Report:Solar Industries (MyIris)

Did Twitter lose the plot? (Om Malik)

25 Things I wish I knew when I graduated (Market Watch)

Startup: La Ruche Qui dit Oui ! (A VC)

Categories

RBL Bank 2015 Financial Highlights

(Disclosure:I am market making in the shares of RBL Bank)

[gview file=”https://alphaideas.in/wp-content/uploads/2015/06/RBL-BANK-ANNUAL-REPORT-14-15-EM.8-9.pdf”]

Categories

Best advice that Grandpa can give