If you purchased #Reliance shares for Rs.10 lakh on 26th August 2007, you would today have exactly the same- 10 Lakh. 8 years of #longterm

— Rajat Sharma (@SanaSecurities) August 26, 2015

Author: Raoji

Manish Kumar is the Chief Investment Officer of ICICI Prudential Life which has a AUM of more than 1 Lakh Crores.

Here is what he said 2 weeks back

On #InBusiness, Manish Kumar, ICICI Pru Life: Don’t expect Nifty to break 8000 on the downside. pic.twitter.com/ZMzCsIVtYg

— Bloomberg TV India (@BloombergTVInd) August 21, 2015

Forecasting Folly, anyone?

The New Bear Market

Linkfest: September 02,2015

Some stuff I am reading today morning:

MAT relief for foreign investors (Mint)

Indian tyre makers no match for the Chinese (Onkar Kanwar)

Is Enam buy paying off for Axis Bank at last? (ET)

Interview with S Naren,CIO of ICICI Pru Mutual Fund (VRO)

Prabhat Diary IPO gets screwed (Moneycontrol)

Religare Research:Buy UltraTech Cement (MyIris)

Latest Bank FD rates for Sept 2015 (MyInvestmentIdeas)

Modi making progress on stalled projects (Bloomberg)

Why Fed will raise rates this year (Barry)

How much diversification is necessary? (Common Sense)

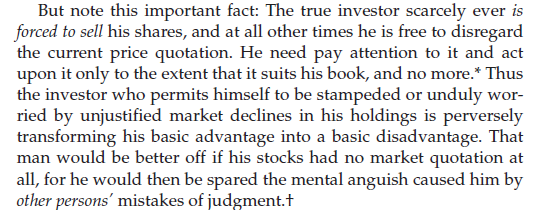

A True Investor & Market Declines

Source:Jason Zweig