Interesting day – Lots of stocks with crazy debt / cdr / defaulters were up today 52 wk highs and the #banks who funded them at 52 wk lows

— Nooresh Merani (@nooreshtech) January 5, 2016

Author: Raoji

Linkfest:January 06,2016

Some stuff I am reading today morning:

Big Shots queue up for NHAI bonds (ET)

Multibaggers: Microcaps or Kachracaps (Nooresh)

Could Coal India become a victim of its own success? (Mint)

Harendra Kumar’s stock pick for 2016 (OB)

The age of being average (Prashanth)

How to plan for retirement using PPF (VRO)

Why $1.5 Billion Nevsky Capital is shutting down (Zerohedge)

China to intervene after $590 Billion sell off (Bloomberg)

Wise investors should be playing the long game (Telegraph)

Natural Gas is 2016’s Trade of the Year (DR)

What, Me Worry?

☃ CMIE Dec quarter report sends a chill down policy corridors. New investment proposals fall 74% & commissioning of projects drops 49%.

— Vinayak Chatterjee (@Infra_VinayakCh) January 5, 2016

Calling India’s bullshit

Data releases have become much less transparent and truthful at both a macro and a micro level. At a macro level the key issue is the ever increasing importance of China and India. China is the world’s second largest economy, but already much larger than the US in a broad swathe of sectors. India will be the world’s third largest economy within a decade. Unfortunately their rise is increasing the global cost of capital because an ever growing share of the most important data they produce is simply not credible. Currently stated Chinese real GDP growth is 7.1% and India’s is 7.4%. Both are substantially over stated. This obfuscation and distortion of data, whether deliberate or inadvertent, makes it increasingly difficult to forecast macro and hence micro as well, for an ever growing share of our investment universe.-from Nevsky Capital’s letter to clients

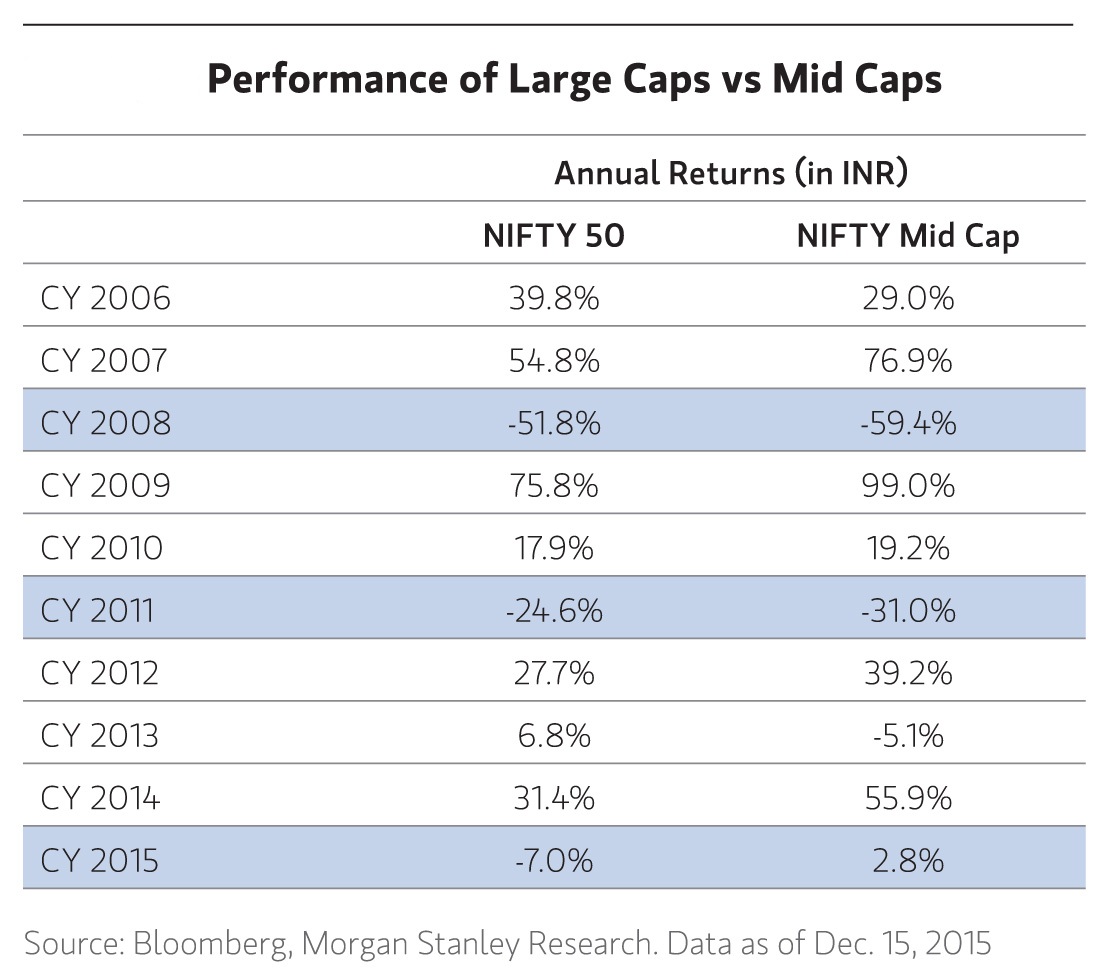

Chart:Large Caps Vs Mid Caps