Career advice:

Somewhere between Winning and Surviving is Outlasting – which is way underrated.

Outlast the bastards.

— Downtown Josh Brown (@ReformedBroker) February 11, 2015

Author: Raoji

Ad: Kind of Genius

Crackpots invest alone

American virologist David Baltimore, who won the Nobel Prize for Medicine in 1975 for his work on the genetic mechanisms of viruses, once told me that over the years (and especially while he was president of CalTech) he had received many manuscripts claiming to have solved some great scientific problem or to have overthrown the existing scientific paradigm to provide some grand theory of everything. Most prominent scientists have drawers full of similar submissions, almost always from people who work alone and outside of the scientific community. Unfortunately, none of these offerings has done anything remotely close to what was claimed, and Dr. Baltimore offered some fascinating insight into why he thinks that’s so. At its best, he noted, good science is a collaborative, community effort. On the other hand, crackpots work alone.

American virologist David Baltimore, who won the Nobel Prize for Medicine in 1975 for his work on the genetic mechanisms of viruses, once told me that over the years (and especially while he was president of CalTech) he had received many manuscripts claiming to have solved some great scientific problem or to have overthrown the existing scientific paradigm to provide some grand theory of everything. Most prominent scientists have drawers full of similar submissions, almost always from people who work alone and outside of the scientific community. Unfortunately, none of these offerings has done anything remotely close to what was claimed, and Dr. Baltimore offered some fascinating insight into why he thinks that’s so. At its best, he noted, good science is a collaborative, community effort. On the other hand, crackpots work alone.

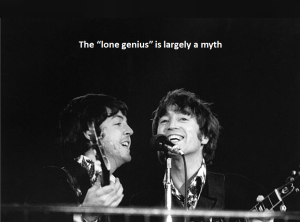

Similarly, the idea of a lone genius changing the world is also a myth. As The Los Angeles Times reported about Bill Gross and PIMCO, “In the wake of [Mohammed] El-Erian’s departure, stories leaked out about Gross’ imperious behavior – traders were forbidden to speak to him or even make eye contact on the trading floor, the Wall Street Journal reported. He brooked no discussion or debate about his trading strategies and became hostile to rising talents on the floor.” Whether we’re talking about Lennon and McCartney or Warren Buffett and Charlie Munger, we all work better with help, advice, support, correction, criticism and accountability. Make sure you aren’t trying to go it alone in the investment world.

Similarly, the idea of a lone genius changing the world is also a myth. As The Los Angeles Times reported about Bill Gross and PIMCO, “In the wake of [Mohammed] El-Erian’s departure, stories leaked out about Gross’ imperious behavior – traders were forbidden to speak to him or even make eye contact on the trading floor, the Wall Street Journal reported. He brooked no discussion or debate about his trading strategies and became hostile to rising talents on the floor.” Whether we’re talking about Lennon and McCartney or Warren Buffett and Charlie Munger, we all work better with help, advice, support, correction, criticism and accountability. Make sure you aren’t trying to go it alone in the investment world.

-from RPSeaWright

ICICI Pru Ulip bet pays off

(Disclosure:I am market making in the shares of ICICI Pru Life)

ICICI Prudential Life Insurance Company is reaping the benefit of focusing on unit-linked insurance plans (Ulips).

The private sector insurer is witnessing a robust growth in its new business premium as Ulips are back in favour among savers with stocks hitting record levels. The share of Ulips in the company’s product basket has also inched up.

Ulips are insurance-cum-investment plans where some portion of the premium goes towards providing an insurance cover and the rest is invested in equities or debt, or a mix of both. They were extremely popular before 2008 partly because of the returns they offered despite high charges.

After the global meltdown in 2008, Ulips fell out of favour as the high charges impacted the returns. However, the bull run at the stock markets, declining interest rates over the past one year and the rationalisation of charges by the Insurance Regulatory and Development Authority (IRDA) have brought the shine back to these instruments.

Ulips accounted for around 42 per cent of the new business premium in 2010-11 but declined to 7 per cent in 2013-14. However, during the first half of the current fiscal, their contribution has risen to 9 per cent. This uptrend has been led by the private sector where their share has risen to 34 per cent during April-September 2014 from 29 per cent in 2013-14.

For ICICI Prudential Life, Ulips now account for a little over 84 per cent in terms of retail weighted received premium for the nine month period ended December against 63.4 per cent in the corresponding period of last year and 66.5 per cent in the previous fiscal. Retail new business premium increased nearly 37 per cent to Rs 3,153 crore from Rs 2,307 crore in the year-ago period. Sources said the private life insurer had also been able to better industry growth rates during the period.-from Telegraph India

Low now,low now..how low can you go?