The Book ‘The Thoughtful Investor‘ is written by Basant Maheshwari who is an well known investor in the Indian Equity Markets and runs a PMS fund.

In the Book, Basant traces his journey as an investor, highlighting the mistakes he made on the way and the lessons learnt.I particularly enjoyed reading about his investments in Pantaloon Retail and Voltas.

The Book is divided into 6 parts:

- The World of Investing-A good introduction for the Beginner investor

- Bull Market,Trends and Bubbles-I really liked the way Basant explained how market tops and bottoms are made

- Company and Financial Analysis-Various financial ratios are explained in a simple and succinct manner

- Buying and Selling Strategies-The most difficult decisions for any investor

- Analysing Sectors and Industries-Spinoffs, Cash Discounts, Banks, NBFCs, PSU stocks, Holding Companies etc are discussed in depth

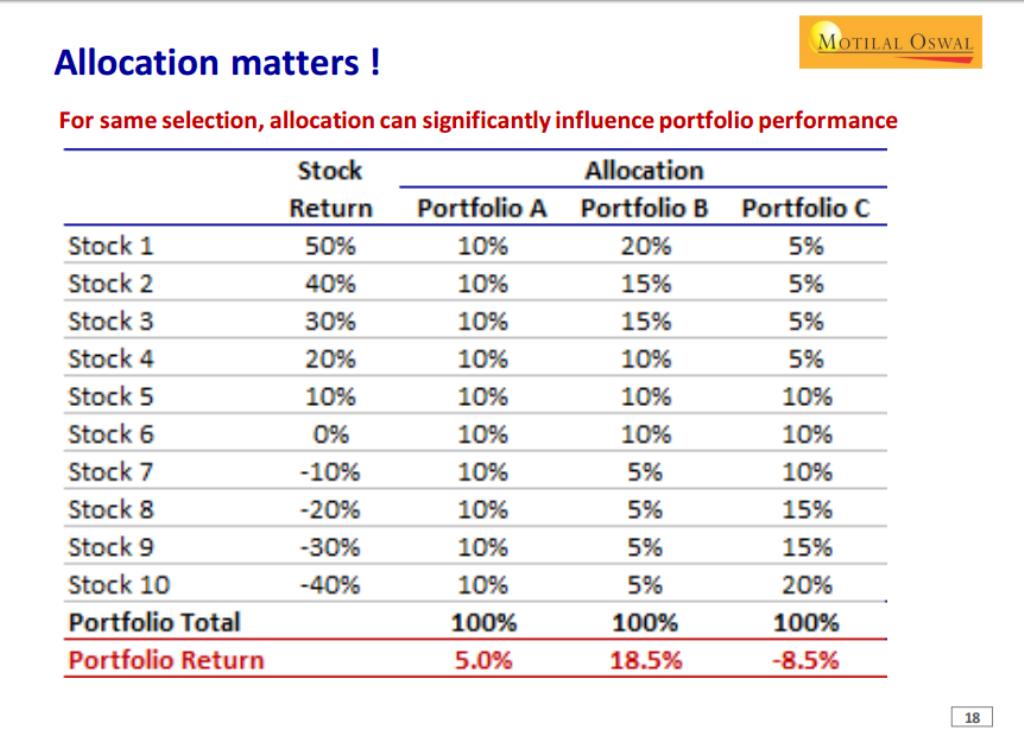

- Portfolio Construction & Leverage-The key decision which will impact your wealth creation journey

The Book is written very crisply with numerous examples from the Indian Context which makes it for a very engaging read.

I would strongly recommend this book for all serious investors in the Indian markets.

Go Buy it.