Source: Dave Forest

Author: Raoji

Linkfest: February 03,2017

Some stuff I am reading today morning:

BSE to start trading on NSE today (Money Control)

Tax on non-STT deals worries market (BS)

Tax evasion figures justify demonetisation (FirstPost)

Budget curtails Income Tax powers (ET)

Investing in second house is tax inefficient (FE)

25 Ways budget impacts you (Apna Plan)

Indian Tech’s post-truth moment (Bloomberg)

Govt looks to raise Rs.11,000 Crores from listing of insurers (BL)

Go invest in micro-caps (Life & Equities)

China’s demand for gold can’t be met (DR)

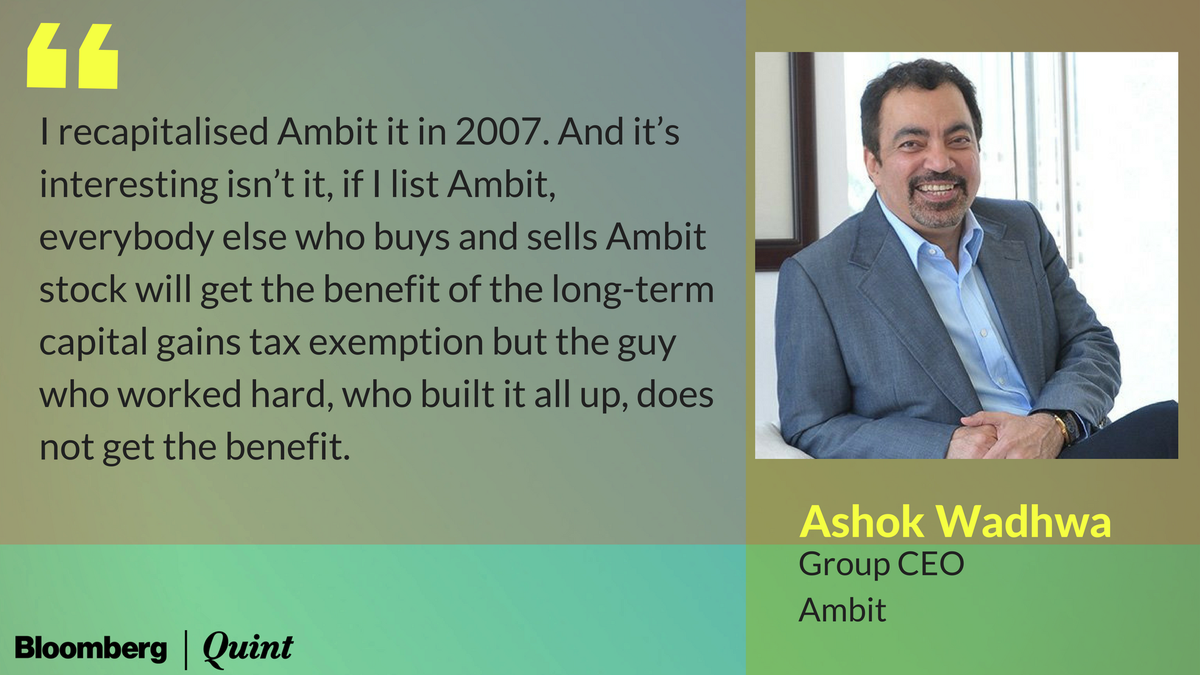

Jaitley’s LTCG tax screws Entrepreneurs

Portfolio of Ashish Kacholia

This post is in continuation of my coat tailing series (see here)

To know what other top investors are buying/holding/selling in India, subscribe to our Investor Wisdom Newsletter

Ashish Kacholia of Lucky Securities is a well known investor in the Indian Equity markets.

His significant holdings in India as on 31 December,2016 as per Stock Exchanges is given below:

| Company Name | Symbol | Entity | # of Shares | % | Value (In Crores) |

| APL Apollo Tubes Limited | APLAPOLLO | ASHISH KACHOLIA | 549587 | 2.33 | 56.54 |

| Ashiana Housing Limited | ASHIANA | Ashish Kacholia | 1285344 | 1.26 | 18.13 |

| AYM Syntex Limited | AYMSYNTEX | Ashish Kacholia | 1404107 | 3.58 | 13.78 |

| DFM Foods Limited | DFMFOODS | ASHISH KACHOLIA | 116715 | 1.17 | 23.27 |

| Genus Power Infrastructures Limited | GENUSPOWER | SUSHMITA ASHISH KACHOLIA | 4566252 | 1.78 | 19.63 |

| GHCL Limited | GHCL | Ashish Kacholia | 1500000 | 1.5 | 43.18 |

| Indo Count Industries Limited | ICIL | Ashish Kacholia | 2495760 | 1.26 | 46.56 |

| Lokesh Machines Limited | LOKESHMACH | ASHISH KACHOLIA | 1800000 | 10.57 | 14.22 |

| Majesco Limited | MAJESCO | ASHISH KACHOLIA | 333340 | 1.43 | 12.76 |

| MT Educare Limited | MTEDUCARE | Ashish Kacholia | 1250003 | 3.14 | 16.53 |

| Navin Fluorine International Limited | NAVINFLUOR | ASHISH KACHOLIA | 165000 | 1.69 | 44.61 |

| Parag Milk Foods Limited | PARAGMILK | ASHISH KACHOLIA | 1579995 | 1.88 | 41.7 |

| Pokarna Limited | POKARNA | ASHISH KACHOLIA | 440636 | 7.11 | 52.44 |

| Royal Orchid Hotels Limited | ROHLTD | ASHISH KACHOLIA | 1073587 | 3.94 | 8.8 |

| S. P. Apparels Limited | SPAL | Ashish Kacholia | 925000 | 3.68 | 35.01 |

| Shreyas Shipping & Logistics Limited | SHREYAS | Ashish Kacholia | 574736 | 2.62 | 13.53 |

| UFO Moviez India Limited | UFO | ASHISH KACHOLIA | 508415 | 1.84 | 23.15 |

| Vadilal Industries Limited | VADILALIND | ASHISH KACHOLIA | 381183 | 5.3 | 22.7 |

| Vishnu Chemicals Limited | VISHNU | Ashish Kacholia | 533783 | 4.47 | 15.84 |

| Vivimed Labs Limited | VIVIMEDLAB | ASHISH KACHOLIA | 1373713 | 1.7 | 13.43 |

| Zen Technologies Limited | ZENTEC | ASHISH KACHOLIA | 2498098 | 3.24 | 18.6 |

Private equity funds and holders of stock options were thrown into confusion by a Budget provision aimed at plugging a black money loophole, fearing that it could land them with a hefty tax bill. Those who acquired shares in unlisted companies after October 1, 2004, will have to pay 10% longterm capital gains tax if they hadn’t paid securities transaction tax (STT) at the time of purchase.

Currently, income arising from the transfer of long-term capital assets such as stocks is exempted from tax if the sale took place on or after October 1, 2004. STT, which was introduced that year, typically applies to listed stocks.

Revenue secretary Hasmukh Adhia sought to allay concerns regarding the measure. “We will come out with detailed rules to exclude genuine investments such as those made through initial public offer, foreign direct investment, Esops (employee stock options),” he said. The measures were aimed at preventing evasion of capital gains via investment in bogus companies. Pending the clarification, there is trepidation that a potent incentive that has helped fuel India’s startup economy could be undermine ..

“An unintended consequence of this rule is to potentially place an onerous tax burden on Esops — which represent the most powerful wealth-creation instrument that cash-strapped startups use to motivate employees,” said Gopal Srinivasan, chairman of the India Venture Capital Association (IVCA).

Punit Shah, partner, Dhruva Advisors, said the new rules will apply to all domestic investors, including promoters of unlisted Indian firms. “They would acquire shares either by subscription or in the form of any group restructuring and would not pay STT at the time of acquisition. But now they may have to pay long-term capital gains tax on exit even after listing of such shares,” he said.

Another announcement, hidden in the fine print, is the aim to collect more tax if shares of an unlisted company are sold below fair value. This may impact private equity investors who often sell stocks of closely held companies to other financial investors. For instance, if a share purchased at Rs 100 is sold for Rs 150, the 20% tax on longterm capital gains would be Rs 10 a share. But not if the taxman thinks that the fair value of the share is higher than Rs 150 — say, Rs 170. Here, the tax would be 20% on Rs 70 (and not Rs 50), thus raising the tax outgo to Rs 14 (instead of Rs 10) a share. –from ET