Read an article in Bloomberg which underlines the case why Israel attacking Iran is historically inevitable.(see article here).

The odds of this event happening in the next 6 months is around 50-50

If such an event were to come to pass, what will be the implications for the Indian markets?

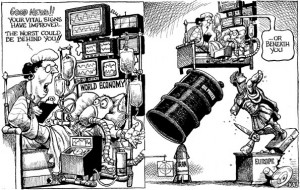

In case of a surprise attack, the following will happen as a knee jerk reaction:

- Oil prices will go up

- FIIs will sell

- Rupee will weaken considerably

- Nifty will crash

- Interest rate sensitives will crash-Banking,Infra,Long term Financing,Auto etc

What happens next depends on the duration of the war.

If it is a short lived war (like the First Gulf War), then it can set the stage for a rally in equities.

If the war turns out to be a longer one and one where the Straits of Hormuz are threatened,then oil prices will continue to remain elevated and the market will slowly and surely grind downwards.

Lesson for long term investors:Keep your powder dry, better opportunities may be round the corner !