When people wax poetic about their conviction in trades, my emotional reaction is: Whatever. A trade is a bet at the poker table. Some bets will work, some won’t; some you’ll size up, some you’ll fold. Whatever. Over time, if you play the odds, you’ll do OK. Beyond that, it doesn’t make a lot of sense to beat the chest and invite overconfidence bias to replace normal confidence.

Every forecast of a statistical model can be wrong. Every trading judgment is fallible. If you have a 50% hit rate on your trades and you trade once a day, on average you’re going to have an occasion in which you lose every day for a week during a trading year. That doesn’t mean you’re in a slump; it doesn’t mean you should change what you do. It’s going to happen and you can mentally prepare yourself–and size yourself in such a way that five consecutive losing days won’t take you out of the game.

The goal is not to eliminate losses–that would require omniscience. Rather, the goal is to anticipate losses so that you’re never surprised, never overwhelmed, never thrown onto the back foot. True confidence comes, not from believing that you must be right, but from knowing that you can survive and even thrive if you’re dead wrong.-from TraderFeed

Tag: trading

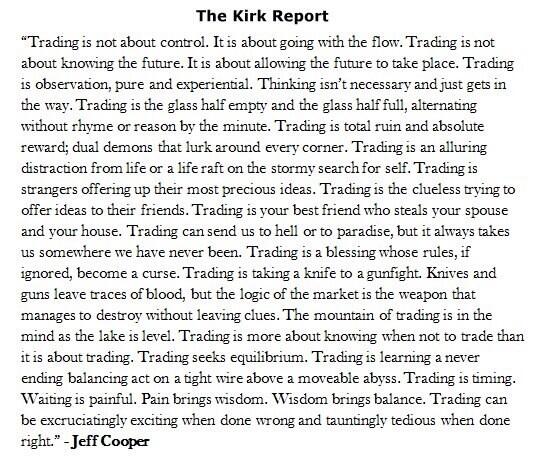

What trading is all about

Hat Tip Steve Burns

The reason I’ve dreaded writing this post for a long time is because I currently find myself taking these questions to the third, and much more gut-wrenching level: Am I being smartly stubborn about sticking with a trading career that holds so much promise? Or am I being stubbornly stupid about a career that gives me nothing but heartache and I should just cut the cord and go dig ditches for a living? I haven’t wanted to write this post because part of me deep down inside fears the answer.

I’m coming up on the 15th Anniversary of my beginning this journey. I started trading in the summer of 1998 and during these 15 years, I’ve experienced fleeting success. Enough to sustain my curiosity, but not enough to secure my financial security. So many times repeatedly over the past decade plus I’ve put tremendous amounts of thought and energy into coming up with trading plans that have a positive expectancy that I was so sure where going to work this time, only to be knocked off course by an errant wave from a direction I hadn’t considered. Again and again. And lately, I’ve been asking myself if riding these waves further out to sea and further away from the Shore of Good Fortune for the past 15 years have been worth it? What do I have to show for it?

Trading is not supposed to be about the money; however, money is undeniably the byproduct of successfully satisfying your curiosity in the financial markets. It is the yardstick by which a Trader is measured. It pains me that after 15 years, it might be more appropriate to measure my success not by a yardstick but by a 12-inch ruler. Most people my age who’ve been in a career for 15 years have achieved some level of financial success and career satisfaction which has allowed them to start families, buy houses, build 401k nest eggs, make investments in other areas of interest, and go on frequent and fun vacations. Me, I’m still grinding it out, fingers crossed that the latest direction I’m on gets me a little bit closer to shore.

Part of me says there is no other path I could have chosen, this is the way it has to be. I wasn’t born with a silver spoon in my mouth. I don’t come from a wealthy family. I didn’t have the right connections, the ivy league pedigree, the Congressman friend to give me insider trading tips. I’m a nobody who was born in a losing town who has to scratch and scrape and fight and sweat just to get a glimpse of the other side of the hill. And then the real work begins when I find out the downhill path to riches is paved with potholes, aggressive speed traps, inclement weather, and a faulty Apple Maps app.

The other part of me – which I’m fighting to suppress – says I’ve already put 15 of my best years into this. If I haven’t achieved my goals by now, when will I? If ever? I should just go and do something more productive with my life before its too late. I’m doing my best to ignore this side of my mind. But this is what makes me wonder if I’m being stubbornly stupid.

I haven’t answered this question yet. The Eternal Optimist in me is leaning toward Smartly Stubborn. My selfish hope is that putting this out there – the act of writing it out to cement my thoughts – will help prevent me from being stubbornly stupid. Only time and P&L will tell. I just hope it tells me soon.-By ChicagoSean