Jeff Gundlach is the CEO and CIO of DoubleLine Capital.

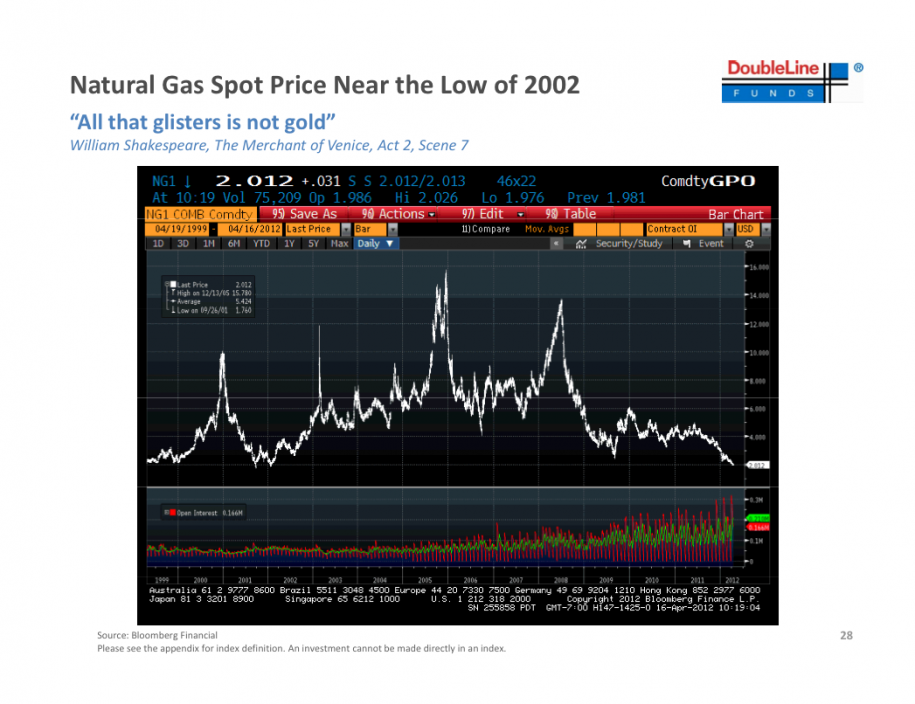

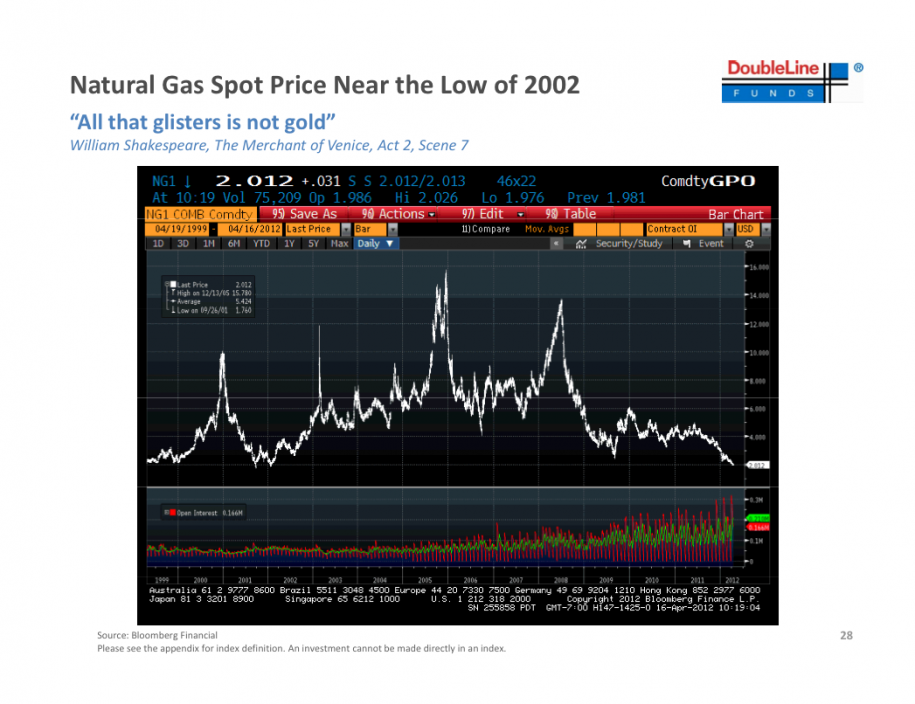

He has an investment idea which he says is akin to buying gold in 1997.

The idea?Buy Natural Gas

Check his full presentation here

Check his full presentation here

Jeff Gundlach is the CEO and CIO of DoubleLine Capital.

He has an investment idea which he says is akin to buying gold in 1997.

The idea?Buy Natural Gas

Check his full presentation here

Check his full presentation here

Your morning reading:

RBI Watch:Annual Policy (RBI)

SEBI misrepresents information (Sucheta Dalal)

Foreign investors shying away from India (Moneycontrol)

Second Greatest Trade of all time ? (Bloomberg)

The next hedge fund trade:Social Media (Barrons)

The risks of derivatives (DailyReckoning)

The awesomeness manifesto (Havard)

Some interesting morning reading:

Infosys results over the last 5 years (CapitalMind)

Indian farmers using cell phones to access power (Bloomberg)

Militants attack Pakistan jail , free 400 inmates (Reuters)

A great read on short selling (Bronte Capital)

Diamonds as a commodity (Nytimes)

HSBC loots actress Suchitra Krishnamoorthy (Moneylife)

Wtf: Fairness creams in India now targeting private body parts (FashionScandal)

In 1932, the father of Security Analysis, Ben Graham wrote an article in Forbes called “Is American Business worth more dead than alive?” .He cited many instances where businesses where sold for a fraction of their net quick assets.

The wealth destruction in the Indian markets in small and mid cap stocks in the last six months has lead to many instances of good businesses being sold for less than their liquidation value

Take for instance Emkay Global..

Started in 1995,Emkay Global is one of the leading brokerages of India with around 350 retail outlets spread across the country.Its finances and stock price has taken a knocking in line with the markets.

For the year 2010-2011,its consolidated results show the following:

Long Term Debt:2.94 Crores

Net Current Assets: 114.15 Crores

Quick Liquidation Value = Net Current Assets- Long Term Debt i.e 111.21 Crores

Quick Liquidation Value/Share= Rs.45.57

Current Market Price of Emkay Global (as on 13 April, 2012) =Rs 29.3

Conclusion: As per the Indian markets, Emkay Global is worth more dead than alive