Consider the following actions of the Govt of India:

Govt of India auctions a block on ONGC on 1st March, 2012.Two weeks later, the same Govt announces an increase in cess on oil production from Rs.2500 per tonne to Rs.4500 per tonne.As per RS Sharma,former CMD, ONGC, “The cess hike will have a bearing on ONGC’s revenues to the extent of Rs 5,000 crore per annum”

The timing of the govt. for the ONGC sale was good, not so for the investors who bought it.

This is similar to the actions of Goldman Sachs.Goldman Sachs sold structured products to investors knowing that they would blow up and in some cases, it actively bet against the same products.

Such sharp deals by Goldman Sachs,Lehman Brothers and their like led Warren Buffet to label them as a “carny”

A carny is a carnival barker hawking rigged games to tempt cash out of unsuspecting bystanders.

The Govt of India by acting as a “carny” has done itself no favors especially when it has huge disinvestment plans lined up (30000 Crores for this fiscal)

Contrast this sort of behavior with that of the Tatas.

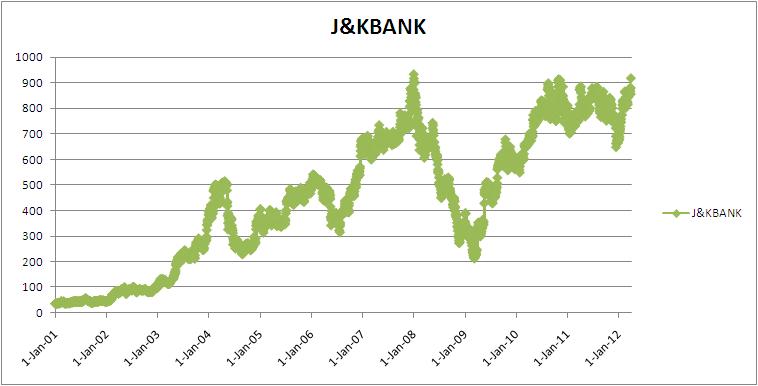

Ratan Tata took TCS public in late 2004.Many times he was asked why did he wait so long, considering that during the late-1990s software boom TCS’s revenues were growing at nearly 60% a year, twice the current rate?

Here is his classic reply (which would have made JRD proud):

“There was a moment six years ago when we considered floating this IPO. But one concern was that the stock markets in India then were not valuing IT stocks realistically. Had we gone public at that time, Tatas being in an enviable position in terms of the money they collected, we would have left many of our shareholders dissatisfied. This was because the IT industry went through a slump [subsequent to 1990s]. We would like this share to be one that investors are happy with, where they see growth, they see enhancement of their shareholder value.”

The Govt of India should act less like Goldman Sachs and more like the Tatas.