One of the oldest sayings in Wall Street is “There is always a bull market somewhere”

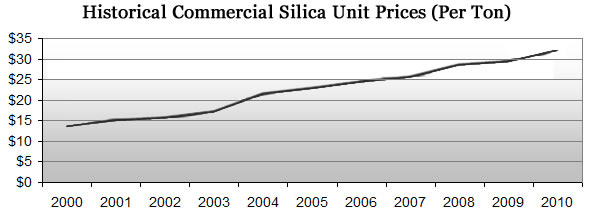

Apparently, now the biggest bull market is in industrial sand. There is a huge – and growing – shortage on the high-quality silica sand required in the fracking industry in the US.

According to Thomas Dolley, a mineral commodity specialist for the U.S. Geological Survey, best described what is going on in the industry… “It’s a gold rush. Demand for frac sand is jumping through the roof.” (see article here and here)