Source:Ambit

Category: Banks

Typically, a corrupt boss uses senior executives such as general managers and deputy general managers for sanctioning loans to undeserving borrowers and pocket a small portion of the loan amount. It could vary from 0.5% to 2-3%, depending on the profile of the borrowing company. This means for a Rs100 crore loan sanction, the “earnings” could be Rs50 lakh to Rs3 crore. The money could be paid in cash or in an overseas bank account (one banker is known to keep this money in his own bank overseas, through the so-called hawala route).

In most such cases, the pressure on giving loans without proper risk assessment mounts on senior executives just ahead of their interviews for promotion. If they don’t oblige, the risk of missing promotion is high. The senior executives also run the risk of being transferred to places not to their liking if they reject a loan proposal, recommended by the boss. The current boss of a government-owned bank has recently told his executives to sanction loan proposals that he recommends (of course, verbally) and not bother about whether they will turn bad. His philosophy is: As long as the loan book is growing, none should bother about non-performing assets as bad loans as a percentage of overall loans can be contained through aggressive loan growth.-wrote Tamal

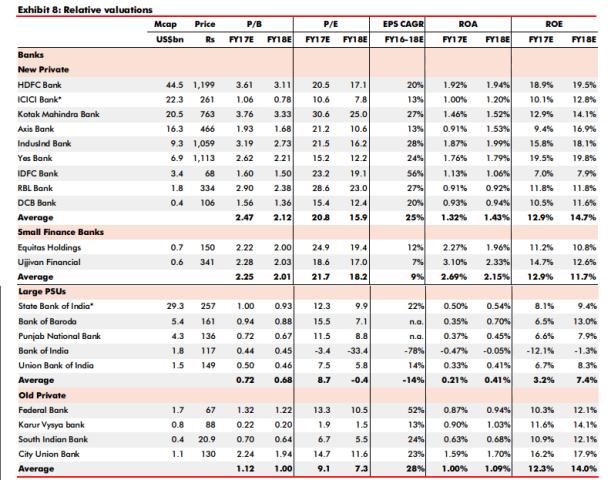

Relative Bank Valuations

Source: Ambit

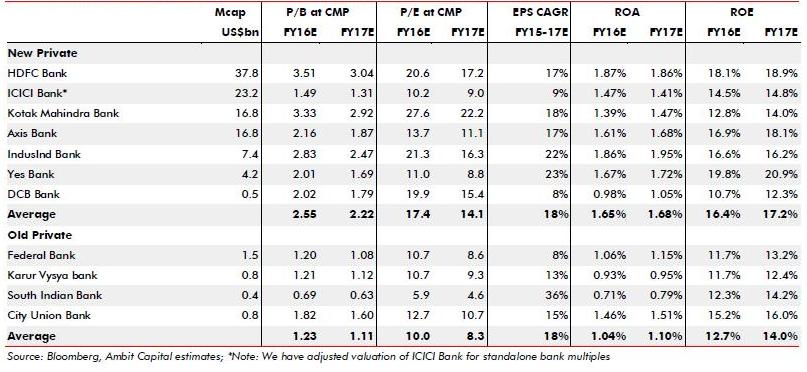

UBS on Bank Valuations

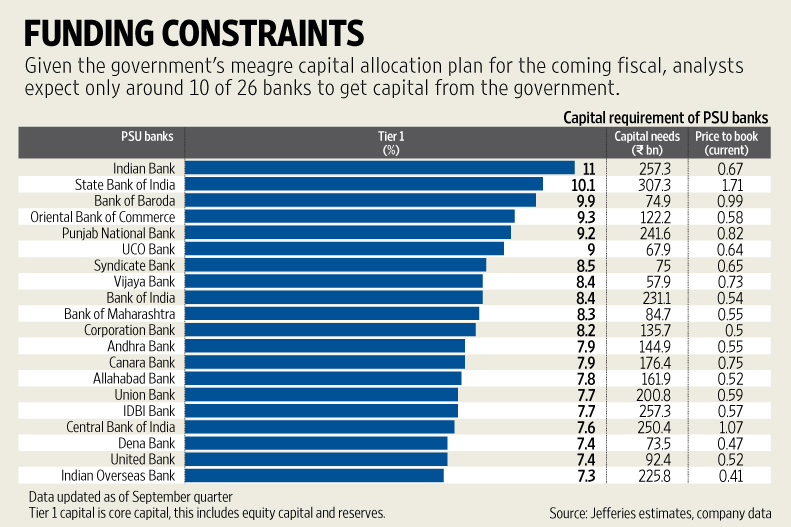

Source:Mint