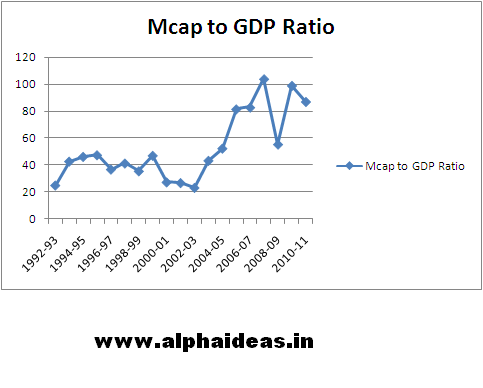

The Market Cap to GDP ratio is used sometimes as an indicator to check the valuations of the markets.

In the Indian context, (using BSE valuations) this ratio really took off after 2002-03.(source:SEBI)

In 2000, according to statistics at the World Bank the market cap to GDP ratio for the U.S. was 153%. Subsequently, the dot com bubble burst.

However, in 2003, the ratio was around 130%, but the market rally continued over the next few years.( see here)

“The correct attitude of the investor toward the MarketCap to GDP ratio might well be that of a man toward his wife. He shouldn’t pay too much attention to what the lady says, but he can’t afford to ignore it entirely !!”