Hat Tip: Divyeshbhai

Category: IPO

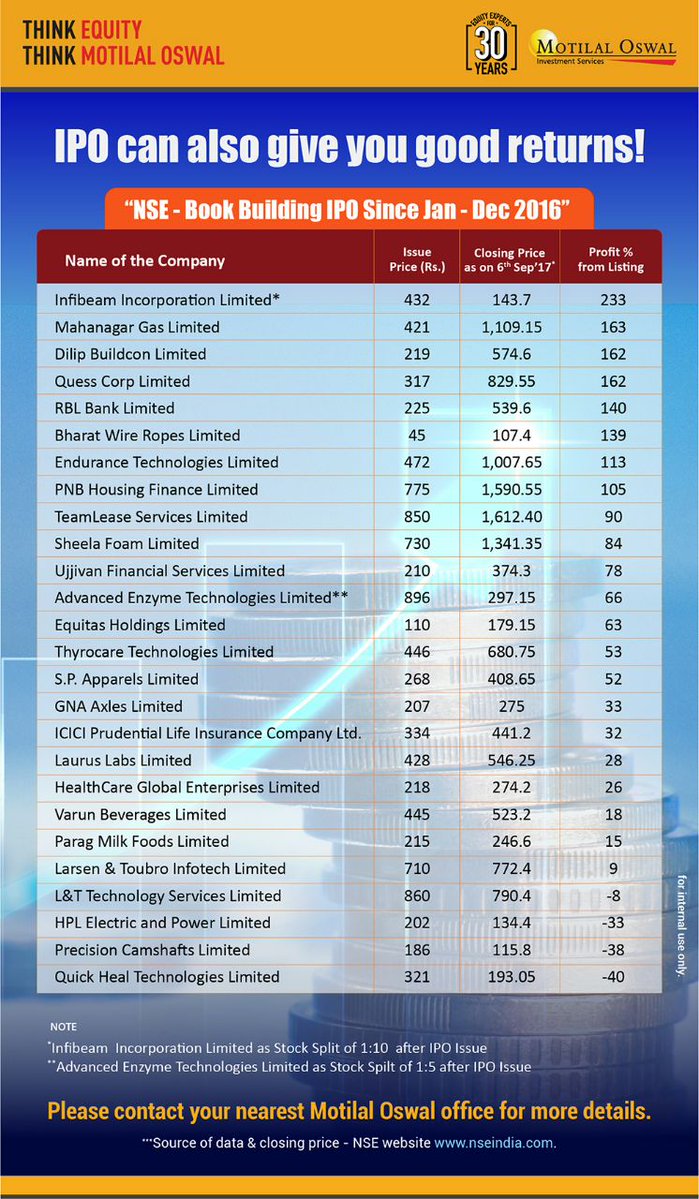

IPOs can also make you money

Best IPOs in the last 15 years

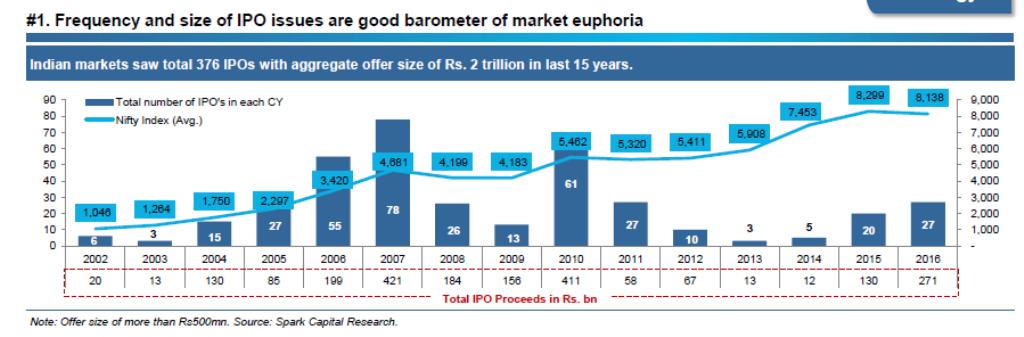

Although primary markets have witnessed initial public offerings(IPOs) worth more than `10,000 crore during CY16, the larger portion of money raised during the year has found its way to existing shareholders.

According to data compiled from National Stock Exchange (NSE), of the `10,740 crore raised during the year via initial share sales, around `5,978 crore was mopped by promoters and private equity (PE) players who sold stakes. The remaining `4,763 crore will be used by companies either to pare debt or as growth capital.

The PE players who pared their holding through IPOs during 2016 include Sequoia Capital, Gaja Capital, Helion Venture Partners, Sarva Capital and Gaja Capital.

The initial share sale of both Mahanagar Gas and L&T Infotech was completely offer for sale(OFS). While Mahanagar Gas raised `1,039.63 crore via IPO, L&T Infotech garnered `1,260 crore, data showed.

Equitas Holdings the biggest IPO during 2016 so far also had a substantial OFS component. The company raised `2,176 crore of which `1,456 crore was on account of complete exits made by six PE players including Sequoia Capital, WestBridge Ventures and Aquarius Investments.

The IPO of Advanced Enzyme, which will hit markets during next week, is also largely an OFS. Out of the `411 crore the company is planning to raise, `361.48 crore is on account of exit by various existing shareholders including Kotak Private Equity.

The trend is also evident in the upcoming IPOs. For instance, ICICI Prudential — insurance arm of India’s largest private bank ICICI Bank —which is planning to launch its IPO by the end of 2016 is a complete OFS. ICICI Bank is planning to sell 10% of its stake in the insurer to fetch more than `5,000 crore-from FE