Depreciation charges are a more complicated subject but are almost always true costs. Certainly they are at Berkshire. I wish we could keep our businesses competitive while spending less than our depreciation charge, but in 51 years I’ve yet to figure out how to do so. Indeed, the depreciation charge we record in our railroad business falls far short of the capital outlays needed to merely keep the railroad running properly, a mismatch that leads to GAAP earnings that are higher than true economic earnings. (This overstatement of earnings exists at all railroads.) When CEOs or investment bankers tout pre-depreciation figures such as EBITDA as a valuation guide, watch their noses lengthen while they speak

–wrote Warren Buffett

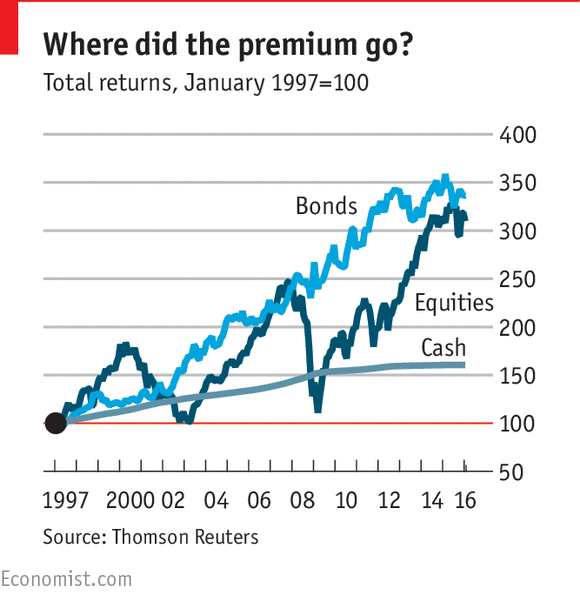

Are equities always the best investment for the long run? It is the message that is usually sold to individual investors. The message is based on theory; equities are riskier than government bonds so should offer a higher return (the equity risk premium, in the jargon) to compensate investors. And the message seems to be borne out in practice, most of the time.

But there is an important caveat. Much of the data quoted by investment advisers is based on America, which is something of an outlier; it turned out to be the most successful economy of the 20th century but that was not guaranteed in advance. An investor in 1900 might have picked Germany as a rising power, only to see their assets wiped out in the 1920s hyperinflation and the Second World War; they might have picked Argentina, which was a perpetual disappointment. In other countries, there have been very long periods in which equities have not been a great investment.

Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School are the acknowledged experts on global investment returns, having compiled data covering 22 countries over more than a century. As of February 2013, the longest period of negative real returns from US equities was 16 years. But it was 19 years for global equities (and 37 for world ex-US), 22 for Britain, 51 for Japan, 55 for Germany and 66 for France. Such periods are much longer than most small investors would have the patience to wait.

Another way of looking at the same issue is whether equities beat bonds over the long term; whether the risk premium is really delivered. This chart, a favourite of Albert Edwards of SocGen, shows the returns from equities (MSCI World, including dividends), long-dated government bonds (over 10-year maturity) and 3 months dollar cash since 1996. Bonds are still winning, even after the big recovery in equities since 2009.

from The Economist

India said it may seize Vodafone Group Plc’s assets in the country if the company doesn’t pay a disputedRs.14,200 crore tax bill that’s still undergoing international arbitration proceedings, according to a copy of the notice that was sent to the company this month.

Anil Sant, deputy commissioner of income tax, informed the company’s Vodafone International Holdings BV Dutch unit of its dues in a letter dated 4 February, according to the document, a copy of which was seen by Bloomberg News. Spokesman Ben Padovan at Vodafone and a representative at India’s tax department declined to comment.

Any overdue amounts, even from overseas companies, may be recovered “from any assets of the non-resident which are, or may at any time come, within India,” according to the letter.

Vodafone has been fighting Indian tax authorities for years over its purchase of billionaire Li Ka-shing’s mobile-phone business in the country during 2007 in a case that analysts have said may influence foreign investors’ perceptions about India.

It’s not immediately clear what the government’s next steps would be if Vodafone were to decline the payment request.-from Mint

There are few signs of overt affluence in what’s still a small town in the India’s sleepy hinterland. At the time of independence, farmers in the region cultivated groundnut, the source of the edible oil that Premji senior was selling through what was then known as Western India Vegetable Products Ltd. Shareholders didn’t see much by way of gains in the early years, recalled Shantilal Jain, who worked at the factory.

A rights offer in the late 1970s wasn’t fully subscribed and Jain was asked to help make up the numbers. He bought one share at a face value of Rs 100. It didn’t seem like a great deal. “Its price fell below the face value and there were no buyers even at Rs 35. Rs 100 at that time was not a small amount and it was not easy to sell it at a loss. So I decided to hold the share,” Jain said. Azim Premji would transform Wipro into a global IT services company.

The worth of that Rs 100 share, after adjusting for splits and bonuses, is now Rs 5.5 crore. Jain, who is 77, has sold some of it but still holds stock valued at more than Rs 1 crore. Rameshlal Korani has been able to build a house funded by Wipro dividends and stock sales. He’s named it Wipro. The biggest bet was probably that of Muhammad Anwar Ahmed. He happened to meet a broker who visited Amalner to buy Wipro shares from the locals in 1980. He invested Rs 10,000, half of all he had.

That’s worth Rs 500 crore now. Ahmed shifted from Amalner to Nashik a few years ago but still keeps in touch with friends and family. For Amalner’s Wipro shareholders, the stock has provided a dependable source of income. None of them would ever want to let go entirely, regardless of what analysts say. “Why should I sell all the shares and buy any other asset. Price volatility does not bother me

Total dividends I have got are in crores and worth more than my shares’ value,” said Korani. Jain said: “If needed, I will sell 10-20 shares in a year but that’s it. As long as the company exists, these shares will remain with us. We trust Sethji (Premji). Whatever he does is will be good for us.”-from ET