Category: Excerpts

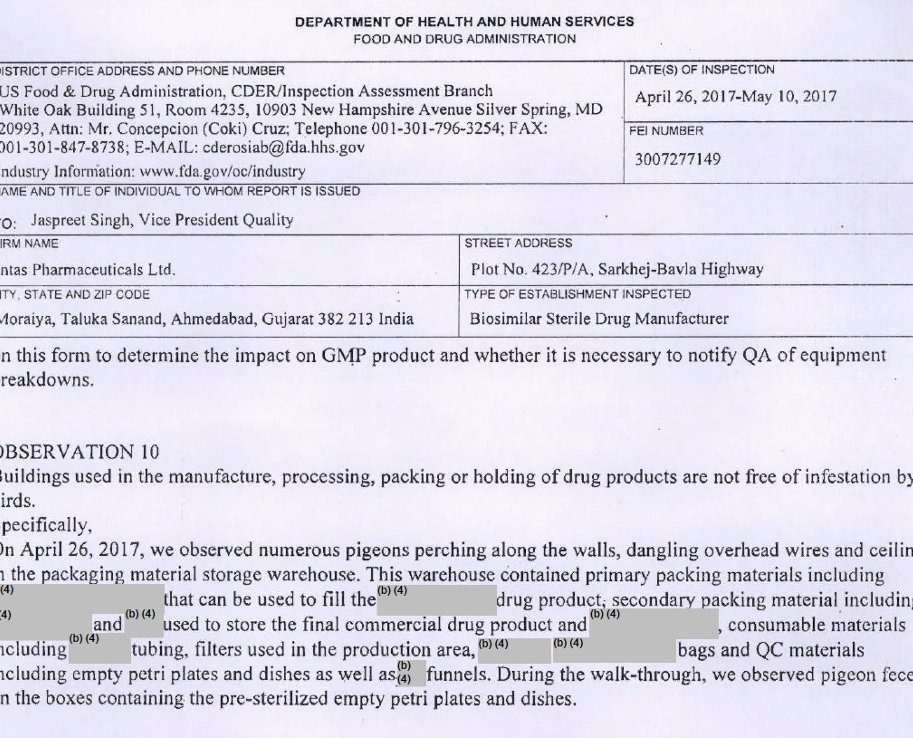

US FDA finds Pigeon Poop @ Intas Pharma

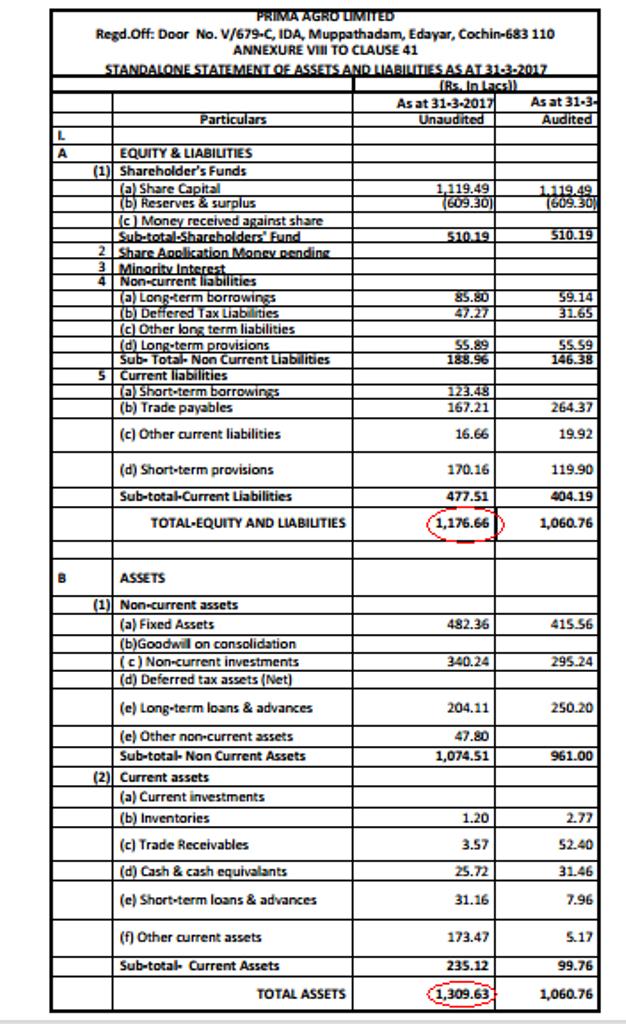

When your Auditors are Jokers

Buffett Moat Vs Bezos Moat

“A Bezos Moat is premised on the idea that the customer is willingly and is frequently entering into a commercial transaction with the company because the customer is deriving more value from the transaction than he or she is paying for.

“A Buffett Moat attempts to identify companies that will be the only one (or one of a few) available in a commercial landscape, so that the customer is, in effect, forced to transact with these companies (i.e. only bridge, only newspaper, only soft drink option).”

-from Base Hit Investing

When a Stock is like a family pet

It’s easy to fall in love with a position that has produced big paper profits for you. Once you learn how to buy extreme bargains during times of crisis, you’re bound to have some massive 100%+ winners in your portfolio.

It’s easy to fall in love with a stock that doubles or triples in value. Seeing it in your portfolio will make you feel good. The winning stock can become like the family pet.

And who wants to sell the family pet?

Trust me… you do.

Extremely cyclical assets like commodities and natural resource stocks should be approached with a “rent, don’t own” mentality. You must be willing to sell these assets after they appreciate in value. It’s only a matter of time before they bust again.

Remember, you don’t make money until you sell. Your “pet” is just a piece of paper. Don’t fall in love with it. It won’t love you back.

-from Katusa Research