Source: Adrian Hernandez

Categories

On Multi-Bagger Stocks

Source: Adrian Hernandez

Source: Adrian Hernandez

Hat Tip: Vetri Subramaniam

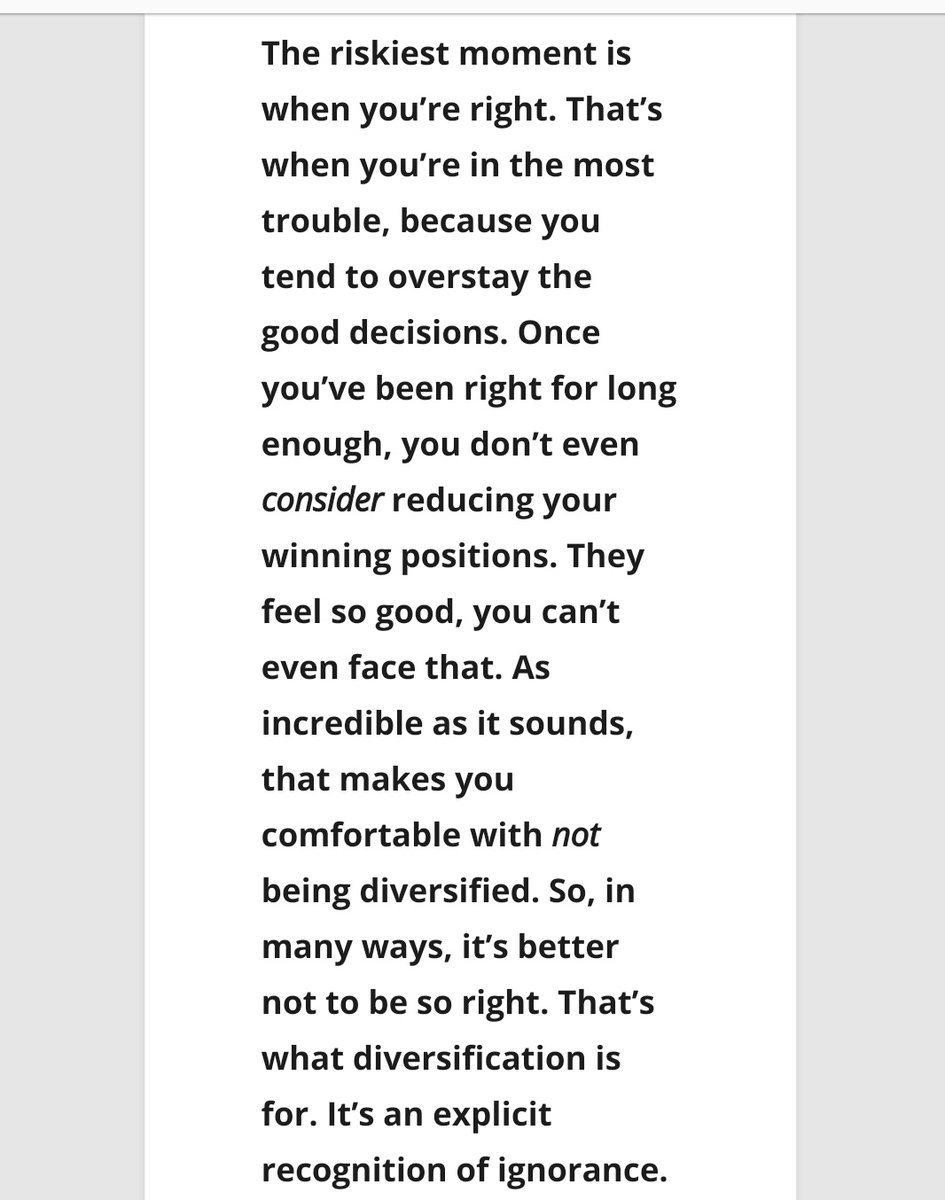

Awesome quote by Peter Bernstein

I was angry with myself for having taken up a fight with the Ambanis. I probably shouldn’t have.

The channel had done an elaborate coverage of how their oil by-products were adulterated. That decision hurt me a lot, which I realised later.

After the dotcom bust, while all stocks took a dive, ours fell disproportionately. In a normal crash, the price of Zee would have come down from its 1,500 peak to about

1,500 peak to about 500 or

500 or 600. But it was down to double digits.

600. But it was down to double digits.

I was devastated.

I still remember the meeting with one of the investors in New York. I broke down. I couldn’t believe that I did so in front of an investor. That was perhaps the lowest point of my life.

Source: April 2018 Letter to Investors