(Hattip Mint)

Category: Currencies

No wonder the Indian Rupee is getting crushed

What was that again?

Over the last two years, India has been inflating at roughly 10% per annum. The dollar has been inflating at roughly 2% per annum. So, it is only natural that the exchange rate will depreciate; the nominal exchange rate which is correcting from the fact that the rupee has been losing value faster than the dollar. By my own calculation compared to two years ago to now, say two years ago Rs 44-45 now I would have expected it to be between Rs 51-54, roughly in that range-Kaushik Basu, Chief Economic Advisor to GoI said in an interview

Whats next for the Rupee?

In an earlier post way back in April, I had mentioned that the odds were very high for the rupee weakening.

Now that the Rupee has crashed to an all time low of around 55 Rs/$, whats next for the Rupee?

There are two distinct factors on the horizon which bode ill for the Rupee.

The first factor is that almost half of Indian reserves could vanish in the next one year.

The second factor is that FII inflows to date in Indian equities are still net positive.If they were to start selling like they did in 2008 because of geopolitical and other reasons, then the impact on the equity and currency markets would be dramatic

We are indeed living in interesting times !

An equation for the Indian Rupee

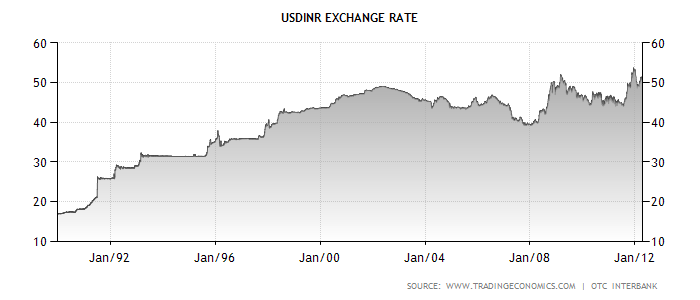

The USD INR relationship for the last 20 years is as shown below:

The last 4 years has been extremely volatile due to the global crisis and the response of the Central Banks to it.

At this particular juncture, the Indian rupee looks very vunerable due to the following reasons:

1.Current Account Deficit:India’s Current Account Deficit for Oct-Dec 2011 nearly doubled from 10.1 Billion $ to 19.6 Billion $ (source:WSJ)

2.This has resulted in a falling of reserves by around 15 Billion $.The trade-based indicator of reserve adequacy viz. import cover of reserves reached a peak of 16.9 months of imports at the end of March 2004. At the end of September 2010, the import cover stood at 10.3 months. (source:ProjectMonitor)

3.Despite the recent CRR cut, the liquidity is extremely tight.(source:RBI) .Banks are borrowing close to 2Billion $ daily from the repo markets. RBI intervention in the currency markets will further worsen the liquidity situation

4.Flows to the capital markets is adversely affected owing to the GAAR news in the recent budget.In the month of April 2012 so far, FIIs have invested only 36.76 Million $ !! (source SEBI)

5.The entire country is expecting a rate cut.Even though inflation figures remain elevated, the RBI governor is likely to cut rates

6.The Govt’s fiscal deficit will worsen over the year.The Food Security Bill , political compulsions and failure to meet its ambitious disinvestment targets (30000 Crores) will ensure that.

7.Geopolitical shocks such as Iran-Israel war and/or reigniting of the Euro crisis will be huge negatives for India

So the equation is:

Wide Current Account Deficit+Falling Reserves+Tight Liquidity+Weak Capital Inflows+Monetary easing+Worsening Fiscal Deficit+Geopolitical Shocks=Weak Indian Rupee