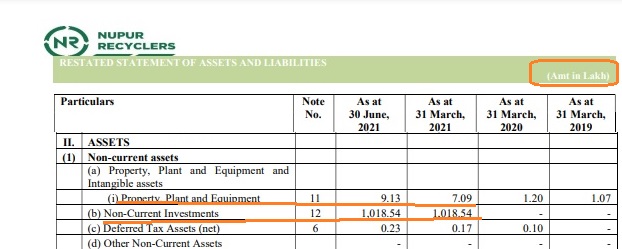

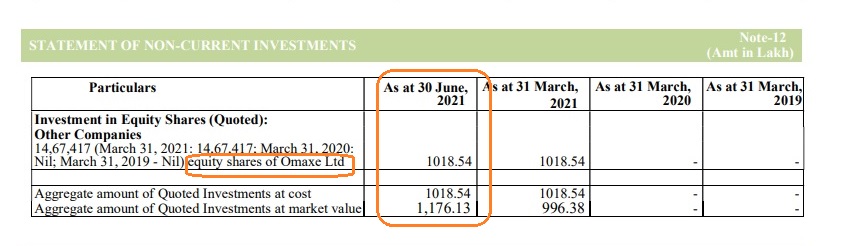

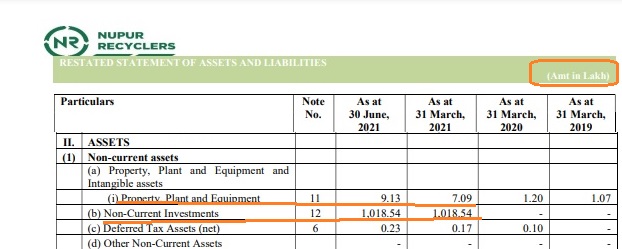

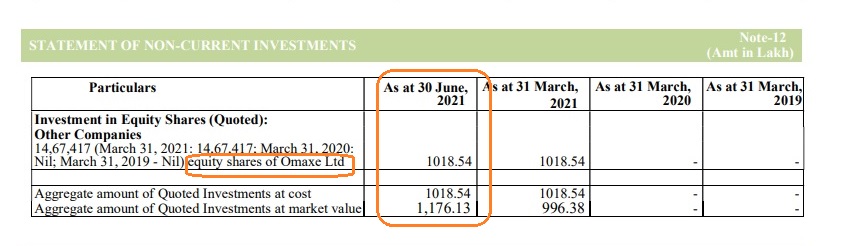

Source: RHP of Nupur Recyclers Ltd

Amusing to see that a co has invested less than 10L in its own fixed assets and around 10 Cr in a listed entity

Source: RHP of Nupur Recyclers Ltd

Amusing to see that a co has invested less than 10L in its own fixed assets and around 10 Cr in a listed entity

3 replies on “Nupur Recyclers: Capital Allocation Champion”

The scrap-recycling business is largely working capital led. So, there’s not much need for FA investments. It’s mostly manual sorting using labour. Their related parties have been in existence for around 2 decades as scrap importers. They can be sort of considered a mid sized player with decent volume sourcing capabilities. But there must be quite a few of their size in different geos.

The equity investments are amusing indeed. But could it highlight inside knowledge? As Omaxe is focused around NCR, Punjab, UP, etc. And Nupur is one of the key players in this region.

nupur means anklets sir. anklets for promoters could be chains for minority share holders sir.

The company’s operation are suspectible. Look at the current cash and bank balance… Taxes has been only provided in the books but not paid since last 2 balance sheet. No fixed assets… Majorly sales converted into debtors. No sales realisation. Major amount invested in one listed entity which is also not performing well. Moreover they have also not paid stamp duty on issuance of share capital. Why sebi is not making proper due diligence before approving ipo? There is a big risk for retail share holder. The company’s going concern is in question..