In the run-up to the sale of BPCL, Govt of India is sparing no efforts to remove excess cash from the co.

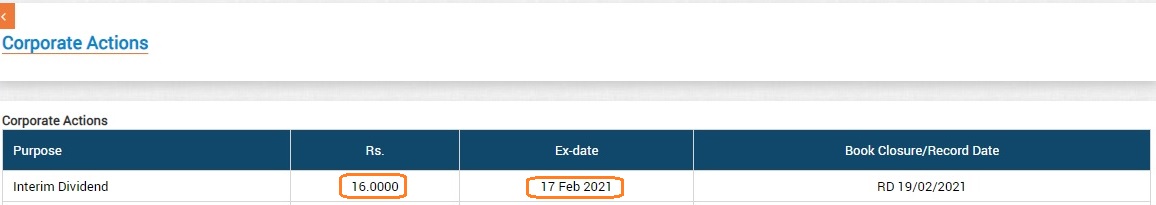

BPCL had given a first interim dividend of Rs. 16/share recently.

Subsequently, it sold the Numaligarh refinery for Rs.9,876 Cr.

This was followed by the sale of treasury stock for Rs. 5,525 Cr.

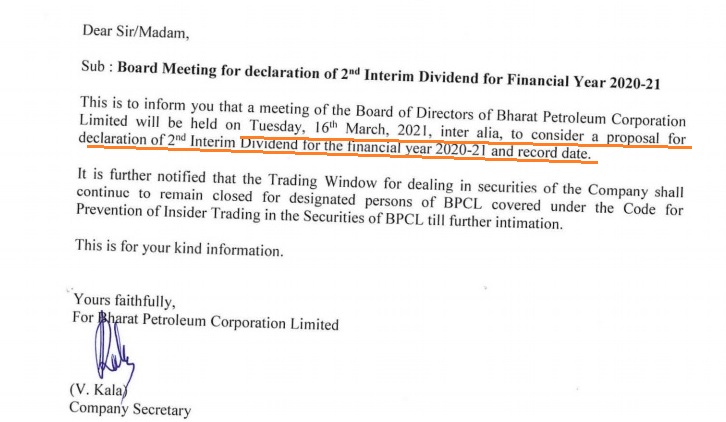

No sooner have these sale transactions being completed, BPCL is now planning to give the second interim dividend.

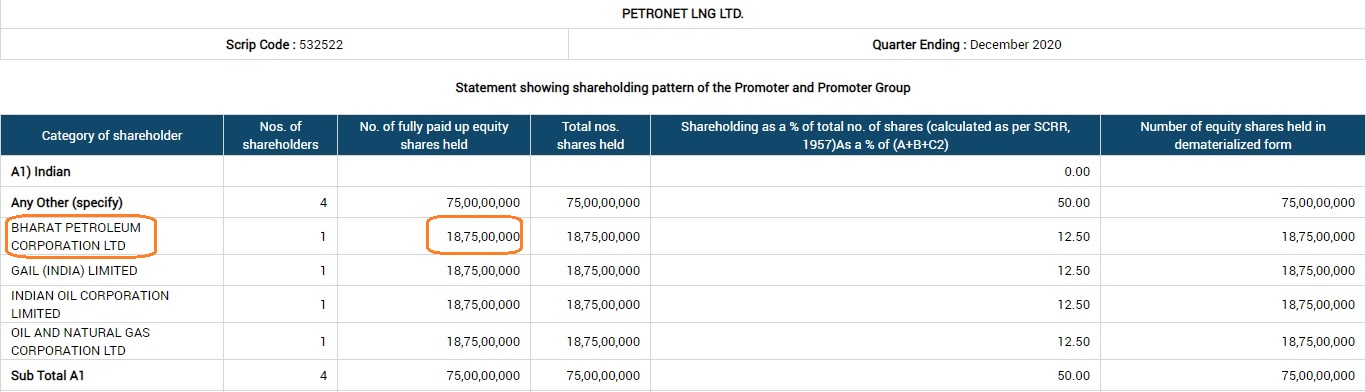

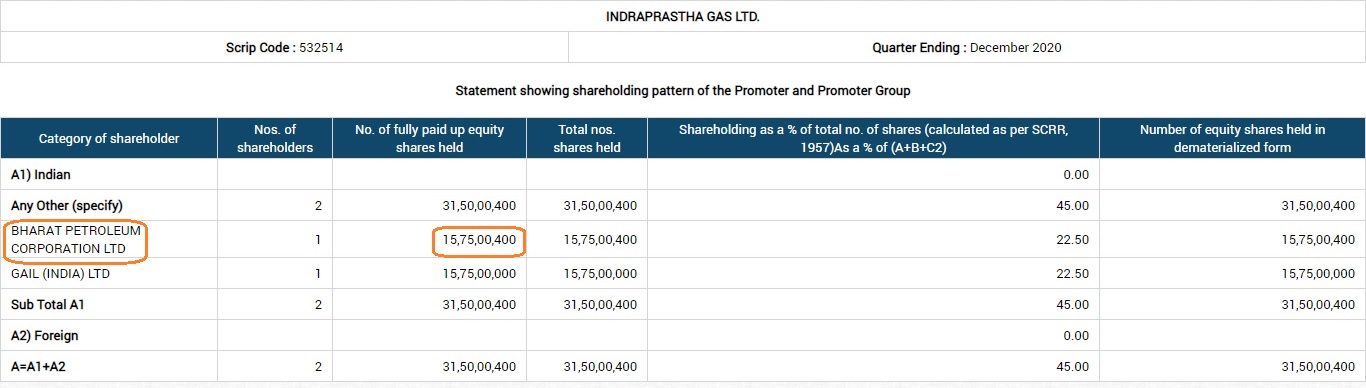

Now, whats interesting is that BPCL is a major shareholder in many valuable cos.

BPCL’s shareholding in Petronet is worth around 4,600 Cr

BPCL’s shareholding in IGL is worth around 8,000 Cr

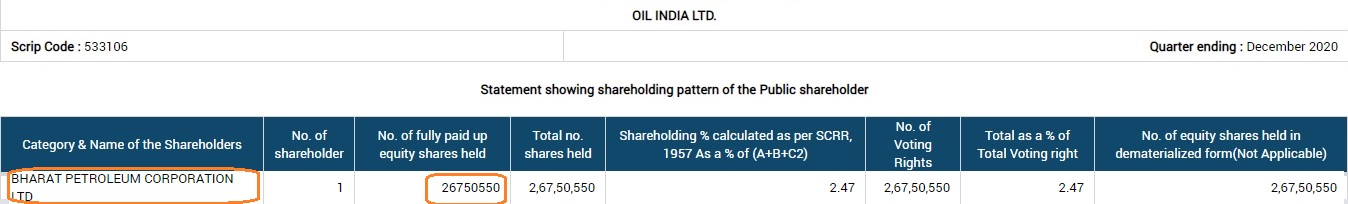

BPCL’ shareholding in Oil India is worth around 352 Cr

In addition, BPCL owns 21% stake in the unlisted Fino Payments Bank which should be worth around 500 Cr or so

By selling these stakes, BPCL can raise an additional 13,450 Cr (pre tax & without discounts) which can be distributed to the shareholders.

The reaction to this possible bonanza by BPCL minority shareholders to Govt of India can be expressed in the meme below