(Disclosure: This post is sponsored by Vested Finance)

Holding a diversified portfolio is a prudent way to protect your returns during market downturns. There are four key types of diversification: asset class (debt, equity, real estate, etc.), industry, time (SIPs) and geography.

Until now, geographic diversification was a tedious and expensive process for Indian investors. But now with technology advancements, it is easier than ever to invest in global markets, specifically the US stock market, the largest equity market in the world.

This kind of geographic diversification not only helps protect against local macroeconomic conditions but also hedge against rupee depreciation.

Over the last decade, the US market has given superior returns when compared to the Indian stock market. There are two key reasons for this.

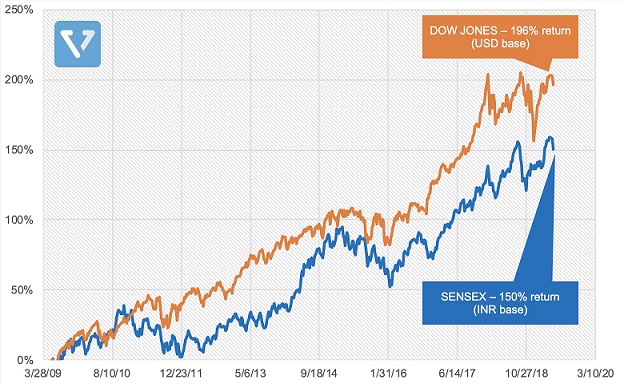

The first reason is that the US market has generally performed better than the Indian market. For comparison, lets look at the performance of the DOW Jones vs. the BSE SENSEX. Over the last 10 years, the DOW has returned 196%, while the SENSEX returned 150%.

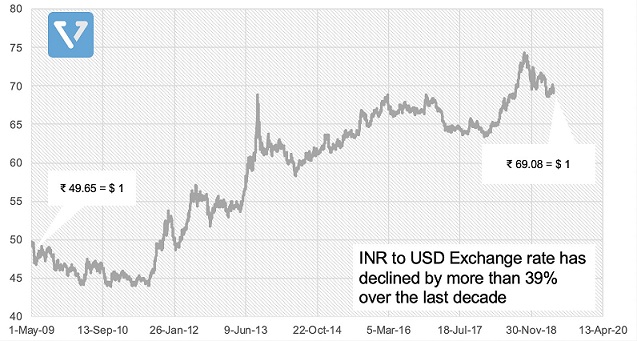

The second reason is that the rupee has depreciated compared to the USD. In the past decade, the exchange INR to USD has declined by 39%. Compounded over 10 years, this makes a large impact on your returns.

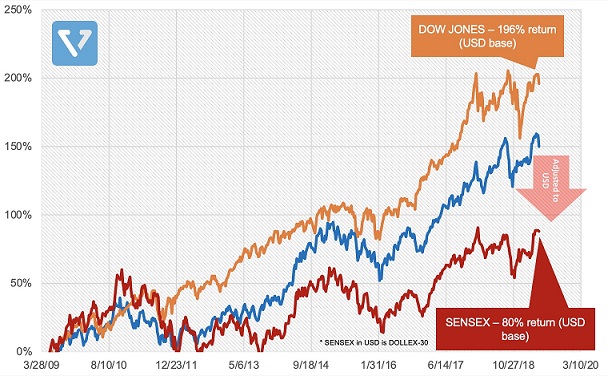

Due to these two factors, the SENSEX, on a USD basis (USD based SENSEX is called the DOLLEX-30), grew only 80% over the last decade, making the performance gap even wider.

To read more about US investing and answers to common questions regarding how taxes would work and the Liberalized Remittance Scheme (LRS), please visit our blog.