Hat Tip: Divyeshbhai

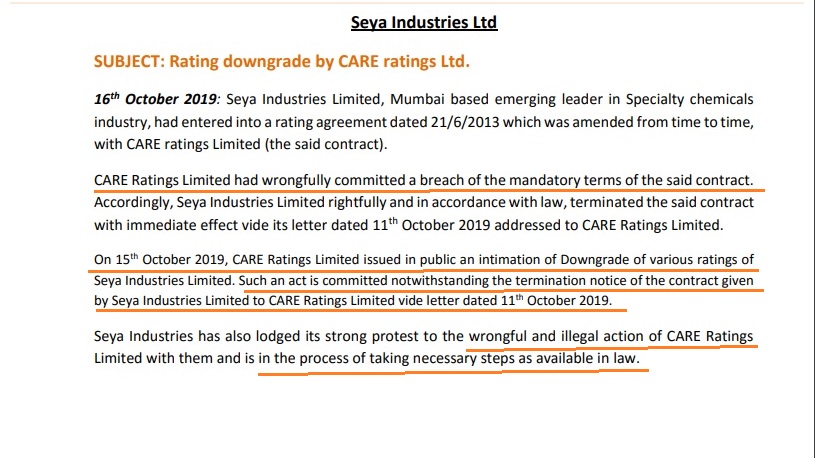

How dare a Credit Agency downgrade a Co’s ratings when it has been pre-emptively fired?

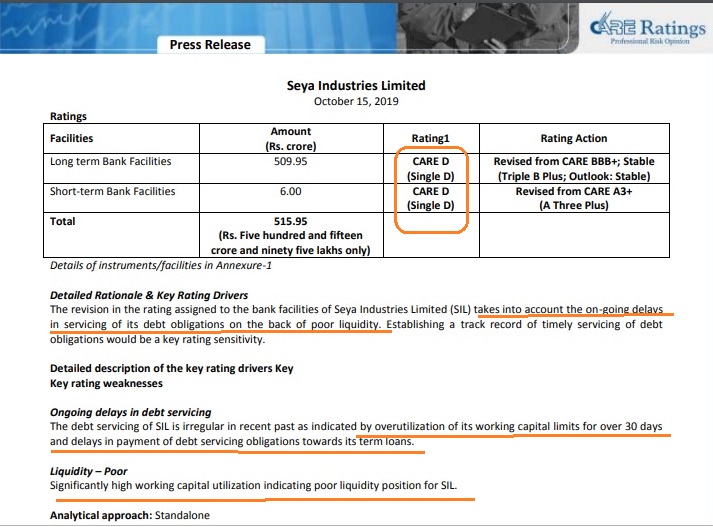

Today Care Ratings downgraded Seya Industries

Seya Industries , not only did not inform the exchanges on 15th Oct about the downgrade but instead gave a blustering response.