Category: Tax

Infographic:Service Tax in India

This post is in continuation of my Infographics series (see here)

Don’t let Chidamabaram hear about this !!

Is this tax planning or tax evasion?

From Pranabda’s white paper on black money

The Vodafone tax case provides an instance of the misuse of corporate structure for avoiding the payment of taxes.

In this case, the Hutchison Group had made investments in India from 1992 to 2006 through a number of subsidiaries having ‘separate corporate personality’ but which were essentially post box companies based in the Cayman Islands, British Virgin Islands, and Mauritius.

The Hutchison Group sold its entire business operation in India in February 2007 to the Vodafone Group for a total consideration of US$ 11.2 billion and the same was effected through transfer of a solitary share of a Cayman Islands

company.

When the tax authorities requested the accounts of the said company, the answer given was that as per Cayman Islands law, the company was not required to prepare its accounts.

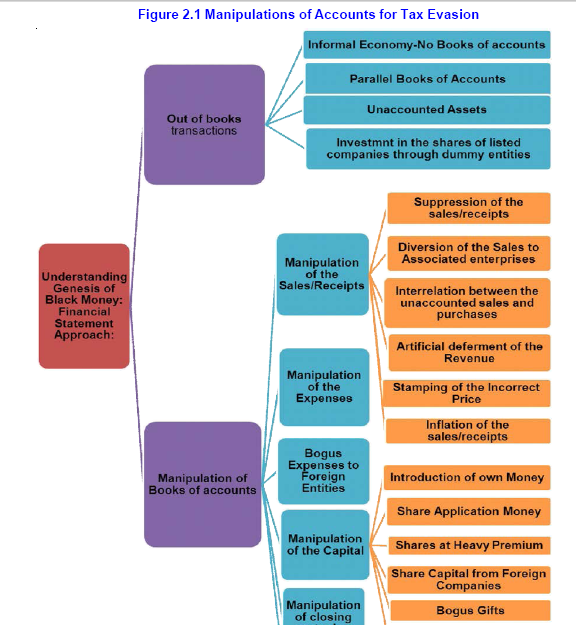

Chart:Genesis of Black Money

A great chart from Pranabda’s white paper on black money